Debt Validation Letter: Definition and Sample

Credit Corp

OCTOBER 16, 2023

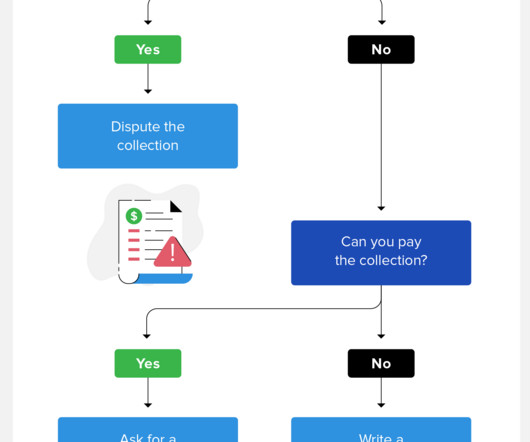

Debt Verification Letter Template + Sample How Long Does a Creditor Have to Respond to a Debt Verification Request? The letter should include details about the debt, the original lender, and the debt collector’s authority to collect the money.

Let's personalize your content