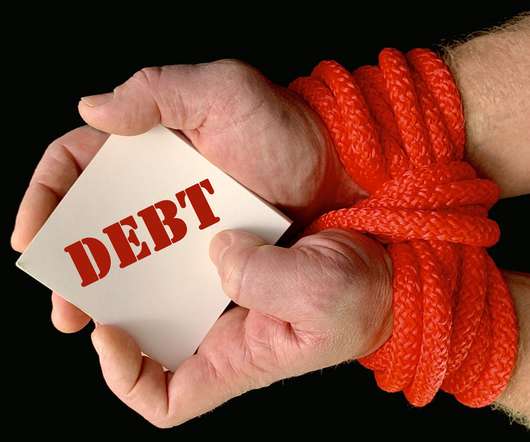

Data Offers Insights Into Collecting From Millennials

Account Recovery

SEPTEMBER 12, 2022

Nearly three-quarters of Millennials are carrying non-mortgage debt, with the average member of that generation owing $117,000, according to the results of a recently released survey. One-third of Millennials … The post Data Offers Insights Into Collecting From Millennials appeared first on AccountsRecovery.net.

Let's personalize your content