Can a Lender Pursue Debt Collection After a Charge Off and 1099-C Issuance?

Jimerson Firm

FEBRUARY 10, 2022

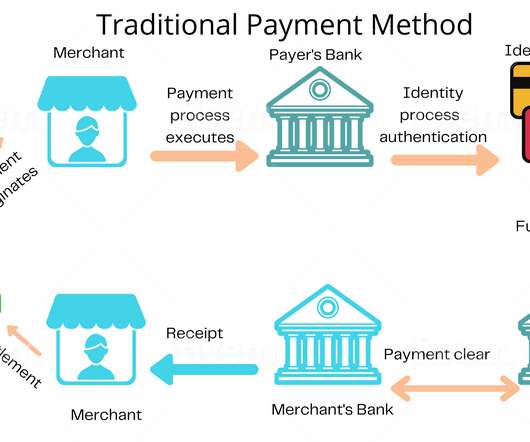

At the same time, however, the account owner/debtor is still responsible for the balance, and the lender/creditor can still make an effort to collect what is owed, with obvious exceptions being discharged or dischargeable bankruptcy filings. Collecting Debts After 1099-C Issuance. Charging Off” Uncollectable Debt. 1.6050P-1(b)(2)(i).

Let's personalize your content