FDCPA Compliance: Answering Your Questions About Regulation F

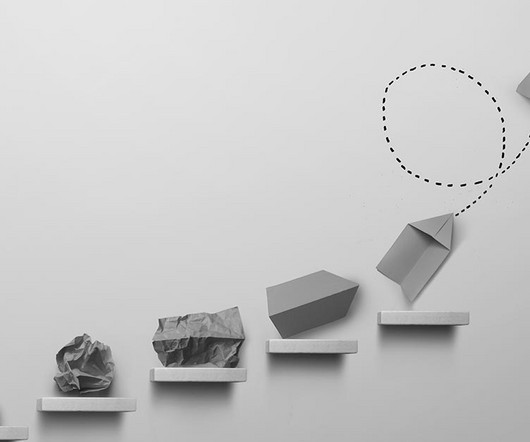

PDC Flow

OCTOBER 12, 2021

Before addressing the questions and concerns from attendees, Needleman and Bender discussed their thoughts on both the positive and negative aspects of the Consumer Financial Protection Bureau’s rule and how they may impact debt collection after November 30. This has been a decade or more in the making ,” said Needleman. “

Let's personalize your content