CCS Offices

Debt Collection Answers

MAY 18, 2023

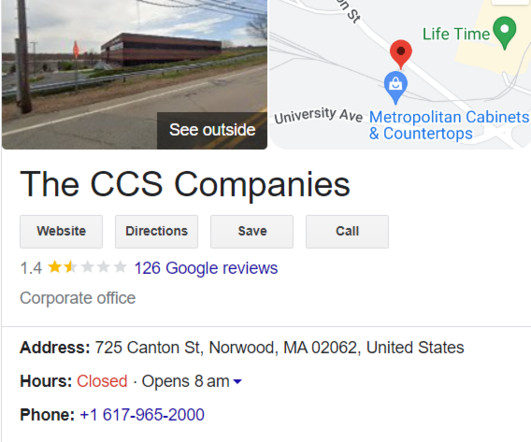

Dealing with debt collection agencies can be unpleasant, and CCS Offices are no different. It’s common for debt collectors to purchase and sell debts, resulting in the possibility of multiple collection accounts from the same debt appearing on your credit report. Who are CCS Offices?

Let's personalize your content