New York to Shorten Time to Collect Consumer Credit Transactions

FFGN COLLECT NY

JUNE 30, 2021

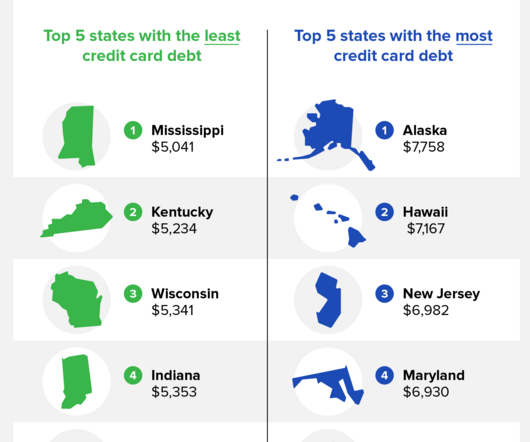

Today, you have six years to collect monies owed from consumer credit transactions. However, a bill approved by the New York Senate seeks to shorten the time to collect consumer credit transactions to three years. Credit union loan. Credit cards. Personal bank loans. Home equity loans.

Let's personalize your content