The Effectiveness of Debt Collection Agencies

Credits Inc

OCTOBER 26, 2019

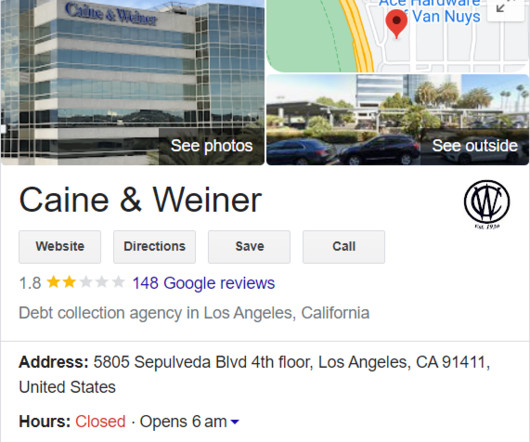

Creditors give loans to millions of citizens, and thus credit companies are too busy to follow up on the debtors. For this reason, creditors are hiring debt collection agencies to collect debts that are 60 days past the agreed period. Therefore, the agencies act as middlemen collecting any delinquent loans.

Let's personalize your content