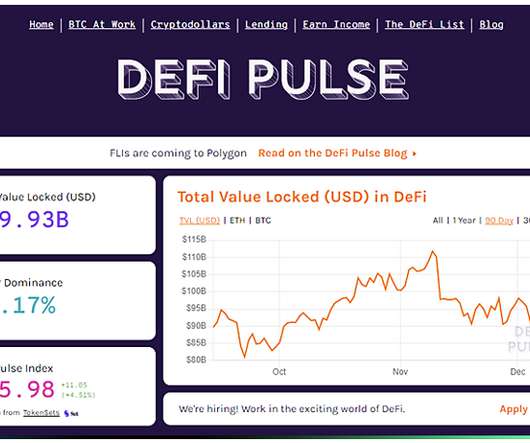

Decentralized Finance (DeFi) is an Emerging Business Trend

Nexa Collect

DECEMBER 12, 2021

DeFi applications reconstruct traditional finance systems revolving around borrowing, lending, trading, and investing with digital assets. A system that interacts buyers, sellers, borrowers, or lenders with peer-to-peer technology to access financial products or financial services bypassing middlemen such as financial institutions.

Let's personalize your content