What Happens After a Personal Loan Bankruptcy Discharge?

Sawin & Shea

FEBRUARY 28, 2024

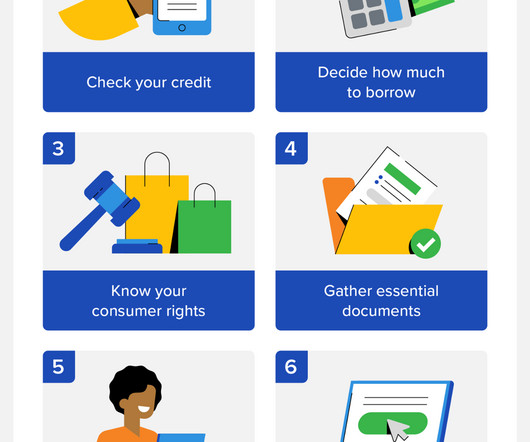

Unsecured loans don’t have collateral. No-credit-check lending, such as payday and title loans, often comes with unreasonable fees and annual percentage rates (APR). When seeking a new personal loan after bankruptcy, use legitimate lenders, such as major financial institutions, credit unions, or through Credit Karma.

Let's personalize your content