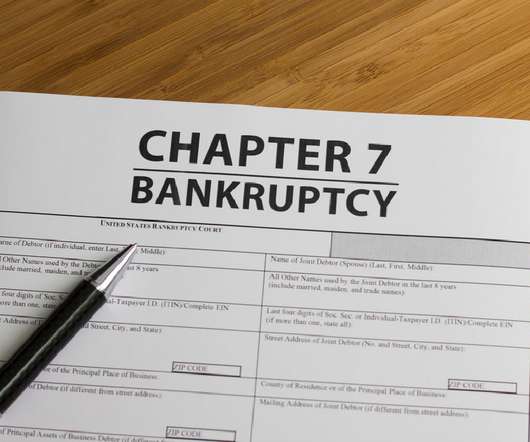

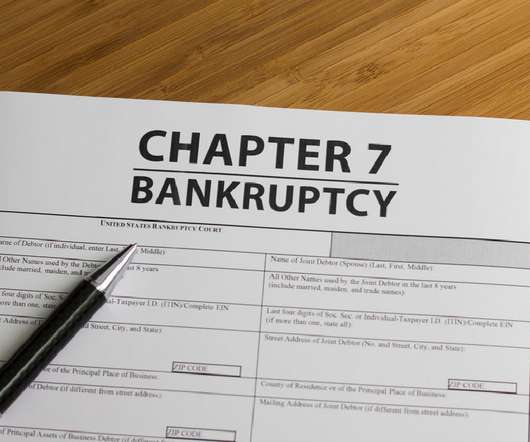

Who Can Declare Chapter 7 Bankruptcy?

Sawin & Shea

JANUARY 18, 2023

If you’re struggling with overwhelming debts, Chapter 7 bankruptcy could be your best option. Chapter 7 is the most common form of bankruptcy for individuals and families, and it allows you to discharge many of your unsecured debts within only a few months. What is Chapter 7 Bankruptcy?

Let's personalize your content