Building Credit During Chapter 13 Bankruptcy

Sawin & Shea

FEBRUARY 9, 2022

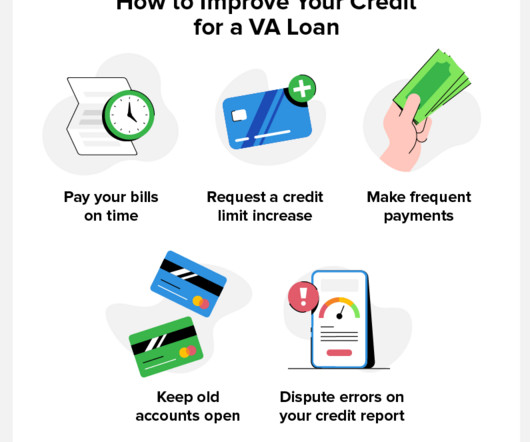

Filing for chapter 13 bankruptcy can seem like a daunting task, but it’s often the right move for those who are facing foreclosure, repossession, or have exorbitant debts. If you’re thinking of filing for chapter 13 bankruptcy, you may have questions regarding how it will impact your credit score.

Let's personalize your content