How Can You Pay a Loan with a Credit Card?

Credit Corp

JULY 25, 2023

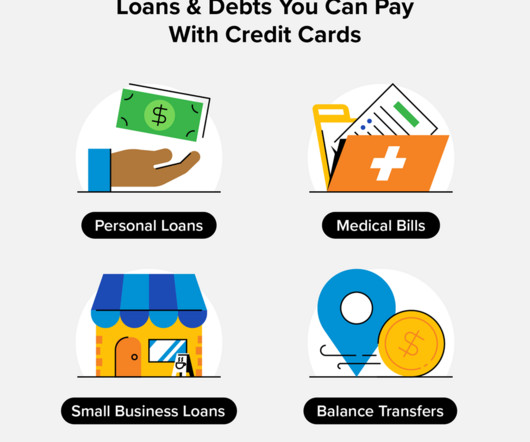

Can you pay a loan with a credit card? Yes, paying a loan with a credit card is sometimes possible. Yet, whether or not you can do so depends on factors such as the lender’s policies or the type of loan you want to pay off. Are you looking for a creative way to pay off your loans?

Let's personalize your content