What Is a Personal Loan? How It Works

Credit Corp

JUNE 12, 2023

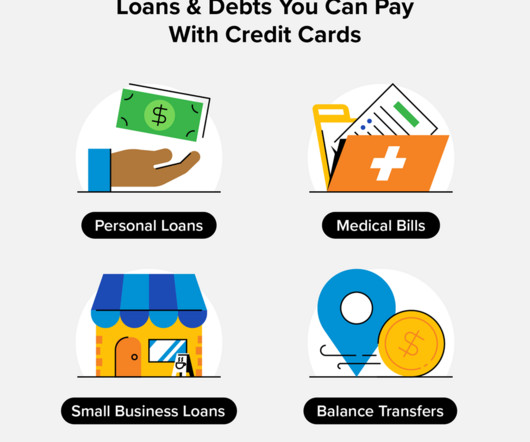

A personal loan is money borrowed from a lender that can be used for almost any purpose, from debt consolidation to home improvement projects. Most people don’t have $5,000+ sitting in their bank accounts—that’s where personal loans come in. What Is a Personal Loan?

Let's personalize your content