What New Debt Collector Rules Mean for You

Nerd Wallet

NOVEMBER 16, 2020

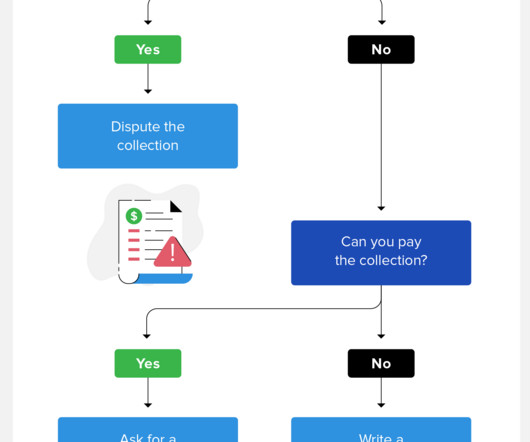

Working with third-party debt collectors can be confusing and scary. adults with debt in collections, knowing their legal rights is crucial. The Fair Debt Collection Practices Act covers third-party debt collectors — those who buy a delinquent debt from an original creditor, like a credit card company.

Let's personalize your content