How To Remove FirstPoint Collections from Your Credit Report

Better Credit Blog

FEBRUARY 18, 2021

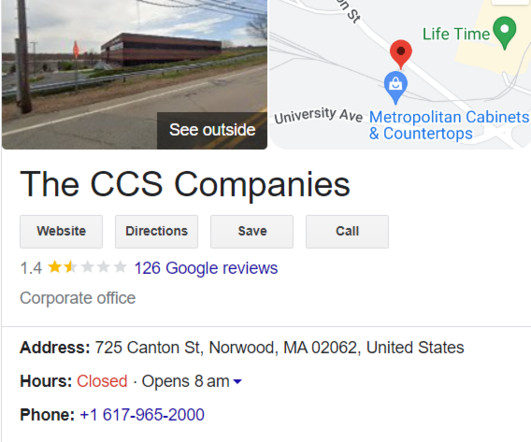

You may start getting calls from a debt collector. Failing to pay your bills will cause the debt to move to collections. This means that your original creditor has officially handed the account over to a collection agency that will hound you for payments. About FirstPoint Collections.

Let's personalize your content