How a Skilled Collections Lawyer Improves Your Odds of Commercial Debt Recovery

Collections Law

SEPTEMBER 24, 2020

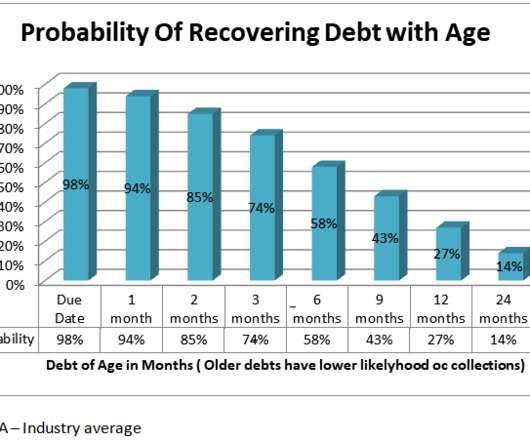

No business should get bogged down in chasing bad debts. That is why you should leave bad debt collection to the experienced aggressive debt recovery attorneys at the Law Offices of Alan M. We have collectively between our two collections attorneys almost 50 years of debt recovery experience. .

Let's personalize your content