CFPB Distributes $384 Million to 191,000 Victims of Think Finance’s Illegal Lending Practices

Payment marks more than $1 billion in total payments from CFPB’s victims relief fund

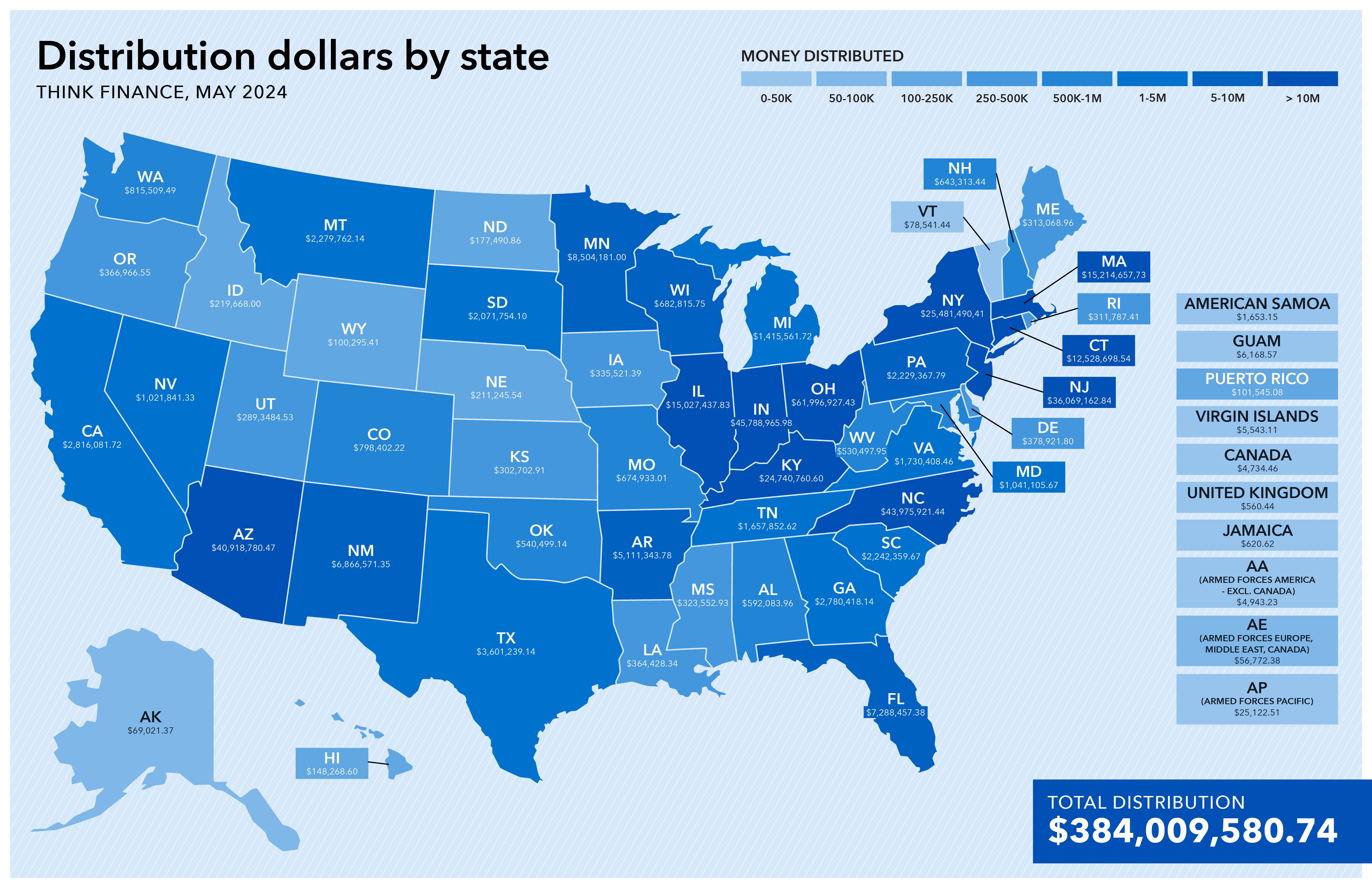

WASHINGTON, D.C. – The Consumer Financial Protection Bureau (CFPB) today distributed more than $384 million to about 191,000 consumers harmed by Think Finance. Think Finance, a Texas-based online lender, deceived borrowers into repaying loans they did not owe. The CFPB distributed the money through its victims relief fund.

The CFPB’s victims relief fund, also known as the Civil Penalty Fund, has distributed more than $1 billion to consumers harmed by scams, frauds, and other illegal practices. The CFPB’s victims relief fund is a unique tool that helps the agency make harmed consumers whole when lawbreakers are unable to fully compensate their victims. Penalties paid into, and disbursed from, the victims relief fund are separate from monetary redress the CFPB orders lawbreakers to pay directly to harmed consumers.

“Too often, victims of financial crimes are left without recourse even when the companies that harm them are stopped by law enforcement,” said CFPB Director Rohit Chopra. “The victims relief fund allows the CFPB to help consumers even when bad actors have squandered their ill-gotten profits.”

Think Finance

In November 2017, the CFPB filed a lawsuit against Think Finance, alleging that the company deceived consumers into repaying loans they did not owe. Think Finance illegally collected on loans that were void under state laws governing interest rate caps and lender licensing requirements. The company misrepresented to consumers that they owed money on these loans, made electronic withdrawals from consumers’ bank accounts, and sent letters demanding payment.

The CFPB’s victims relief fund’s $384 million distribution to consumers harmed by Think Finance is a result of the CFPB's prosecution. This distribution will provide financial redress to thousands of consumers who Think Finance lied to, and who lost money due to the company’s illegal practices.

The CFPB’s Victims Relief Fund

Congress created the CFPB’s victims relief fund in the Dodd-Frank Wall Street Reform and Consumer Protection Act. Since opening its doors, the CFPB has distributed funds to consumers harmed in cases involving a wide range of illegal practices, like student loan and mortgage relief scams, predatory lending, and illegal debt collection.

Most law enforcement tools are designed to find and punish lawbreakers. However, the victims relief fund authorizes the CFPB to compensate harmed consumers. When the CFPB takes legal action against a lawbreaking person or company, the lawbreaker often must pay redress to harmed consumers, in addition to a civil money penalty to be deposited in the CFPB’s victims relief fund. The penalty is saved in the fund, and the money enables the CFPB to provide financial relief in cases where consumers do not receive compensation directly from the company that harmed them.

Importantly, the CFPB is often joined in its enforcement actions by state attorneys general. In appropriate cases, the victims relief fund can ensure that victims in those states will receive financial relief even if lawbreakers cannot afford to pay full compensation.

CFPB’s Law Enforcement Mission

Through its law enforcement actions, the CFPB holds lawbreakers accountable for their illegal practices, and seeks to obtain relief for harmed consumers. The CFPB enforces a wide range of federal consumer financial laws, including the Consumer Financial Protection Act, Truth in Lending Act, Fair Credit Reporting Act, Equal Credit Opportunity Act, and Fair Debt Collection Practices Act.

The CFPB's enforcement actions have resulted in significant financial relief for consumers. To date, more than 195 million consumers and consumer accounts have received approximately $19 billion in the form of monetary compensation, principal reductions, canceled debts, and other consumer relief ordered. In 2023 alone, the CFPB ordered lawbreakers to pay more than $3 billion in consumer relief.

The CFPB's law enforcement work serves as a deterrent to illegal practices in the financial marketplace, sending a clear message that violations of consumer protection laws will have consequences. By holding companies accountable and obtaining relief for harmed consumers, the CFPB helps to maintain trust and fairness in the financial system.

If you were one of the more than 191,000 eligible consumers harmed by Think Finance’s practices, you will be sent a payment beginning on May 14, 2024. Details about the distribution are available at cfpb.gov/payments/ThinkFinance. The CFPB has contracted with Epiq Systems as the settlement administrator to answer questions about payment distributions and the case. They can be emailed at info@cfpb-thinkfinance.org or reached through a dedicated toll-free line at (888) 557-1865.

The total distribution amount is $384,009,581 and the money will come from the CFPB’s victims relief fund.

Consumers can submit complaints about financial products or services by visiting the CFPB’s website or by calling (855) 411-CFPB (2372).

The Consumer Financial Protection Bureau is a 21st century agency that implements and enforces Federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. For more information, visit www.consumerfinance.gov.