The Five Best Mortgage Refinance Lenders

Better Credit Blog

AUGUST 17, 2021

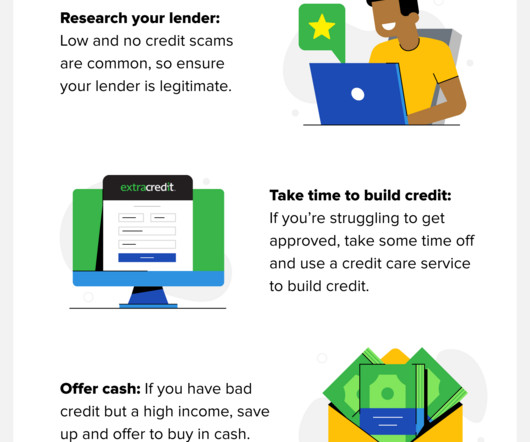

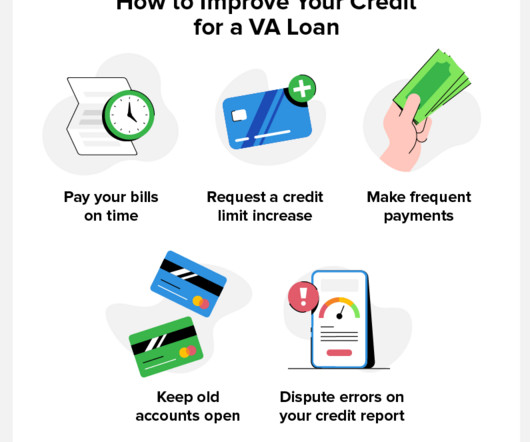

No Most Convenient Better Mortgage Refinance Our Partner Check Price Minimum Credit Score 620 Down Payment 3% Available Terms 30-year, 20-year, and 15-year Average APR Rates 1.750% - 2.375% Home Equity Loans Available? There are several reasons to consider refinancing your mortgage. Select your state to begin refinancing your mortgage.

Let's personalize your content