4 Common Debt Consolidation Mistakes and How to Avoid Them

Nerd Wallet

AUGUST 24, 2021

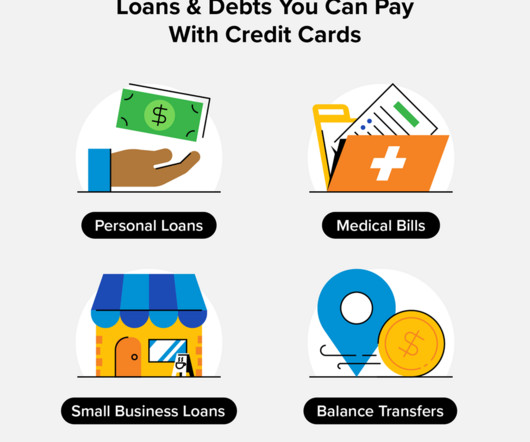

If you’ve amassed multiple forms of debt, like credit cards, medical bills or personal loans, you might be considering consolidating. Debt consolidation is when you combine your debts into one payment, usually with a consolidation loan. Jackie Veling writes for NerdWallet.

Let's personalize your content