IRS Shares Details About 2021 Tax Season; Special Access to Tax Prep Webinar Recording

Account Recovery

JANUARY 13, 2022

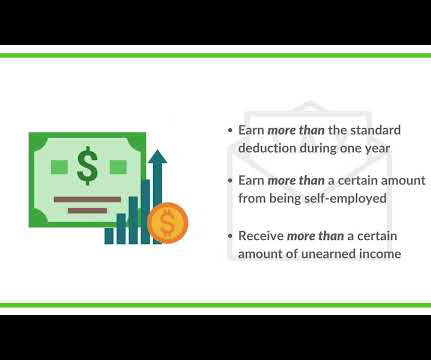

I’ve included a couple of links and references in the “Worth Noting” section of The Daily Digest this week with details about income tax returns, but wanted to put everything together and share access to a webinar recording on the topic of how companies in the ARM industry should be approaching tax season this year.

Let's personalize your content