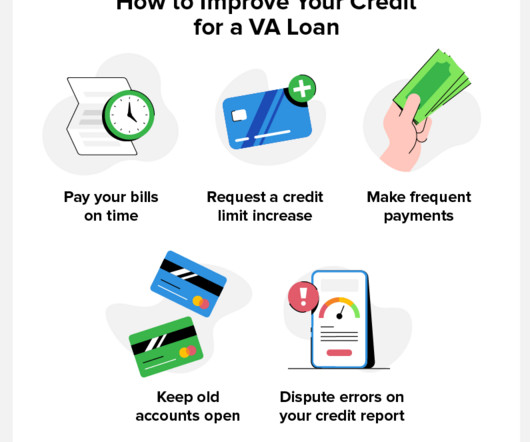

How To Qualify for a Mortgage After Chapter 7 Bankruptcy

Luftman, Heck & Associates.

JANUARY 18, 2021

You have made it through Chapter 7 bankruptcy. But how do you qualify for a mortgage loan after Chapter 7 bankruptcy? The post How To Qualify for a Mortgage After Chapter 7 Bankruptcy appeared first on Cleveland Ohio Bankruptcy Attorneys. Congratulations!

Let's personalize your content