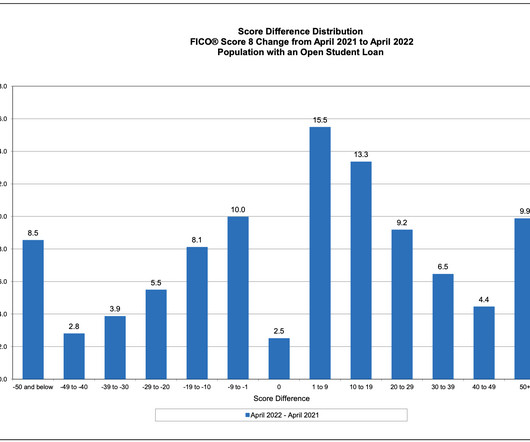

Top 5 Scores Posts of 2022: Steady FICO Score, BNPL and Alternative Data

Fico Collections

FEBRUARY 7, 2023

Saxon Shirley Fri, 05/20/2022 - 06:06 by FICO expand_less Back To Top Tue, 02/07/2023 - 19:10 As the independent standard in credit scoring, FICO® Scores are the leading credit scores used extensively across the lending ecosystem.

Let's personalize your content