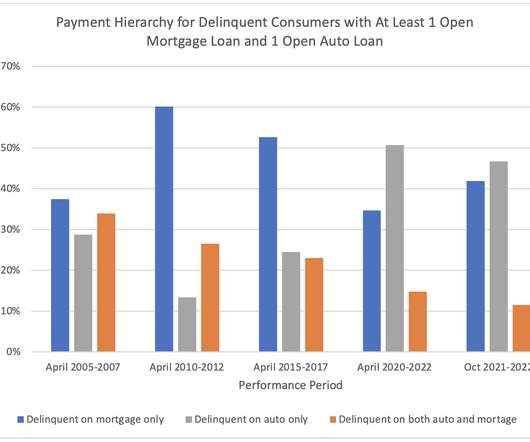

Consumers Prioritize Mortgage Payments Over Auto

Fico Collections

FEBRUARY 10, 2023

Home Blog FICO Consumers Prioritize Mortgage Payments Over Auto What are the drivers behind this mortgage and auto loan payment hierarchy behavioral shift and is it likely to be a lasting trend? Mortgage and home loan accommodations peaked at 9% in June 2020. Mortgage and home loan accommodations peaked at 9% in June 2020.

Let's personalize your content