Cash Flow Data Can Improve Credit Access with an UltraFICO® Score

Fico Collections

JANUARY 5, 2023

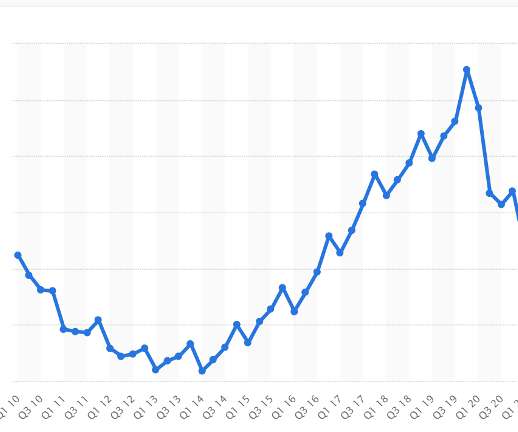

Thu, 08/22/2019 - 12:37. The data reflected in the UltraFICO® Score may improve an individual’s already-existing FICO® Score, but it also can provide credit scores to many individuals who are “unbanked” or “under-banked,” or those who have not had consistent or sufficient access to mainstream financial products, loans or services.

Let's personalize your content