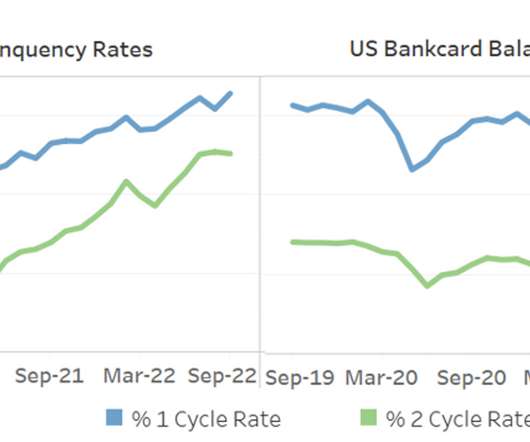

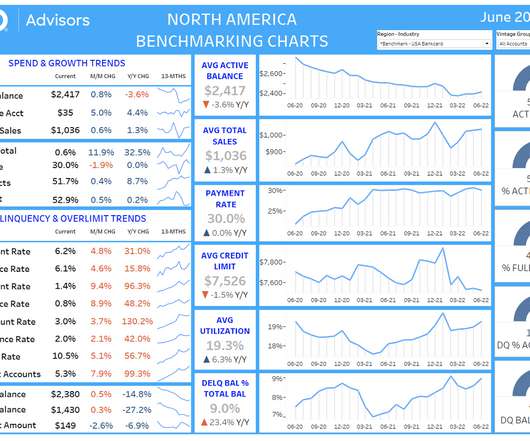

US Bankcards Industry Benchmarking Trends: 2022 Q3 Update

Fico Collections

DECEMBER 6, 2022

Tue, 03/23/2021 - 22:16. One more unknown is how the expiration of student loan payment deferment and the upcoming loan cancellation will impact the overall cash flow of consumers. compared to September of 2019. US Bankcards Industry Benchmarking Trends: 2022 Q3 Update. NicholetteLarsen@fico.com. by Leanne Marshall.

Let's personalize your content