Despite Rapid Adoption of Digital Channels, Customer Trust Lags

Fico Collections

JANUARY 4, 2023

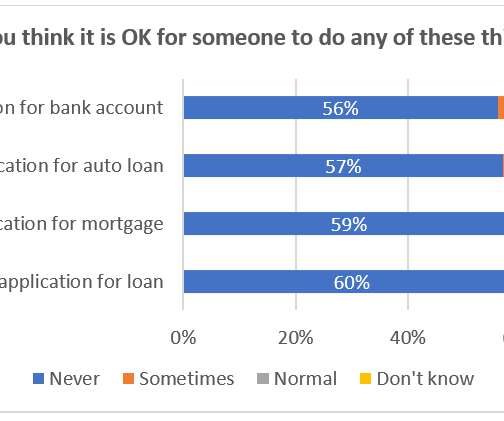

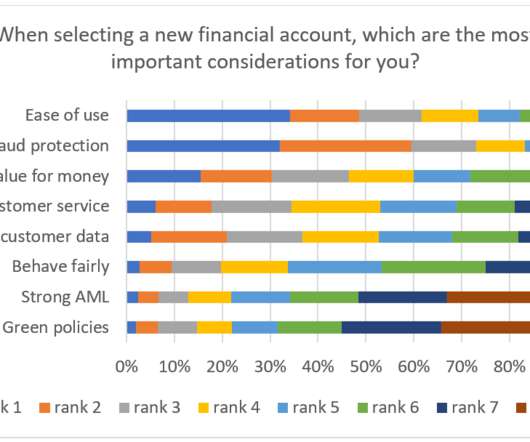

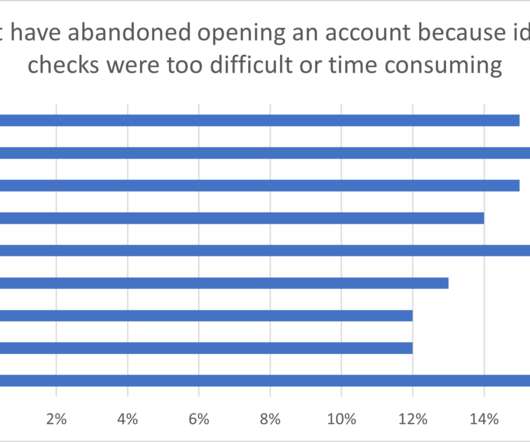

Tue, 07/02/2019 - 02:45. Though adoption of digital banking and e-commerce has grown substantially in the past three years, it isn't the case that all consumers prefer to use digital means, namely web portals or mobile apps, to apply for new accounts, cards, or loans. Accounts via Digital, Loans Not as Much.

Let's personalize your content