Estate Planning 101: Why You Should Start Now

Credit Corp

AUGUST 12, 2021

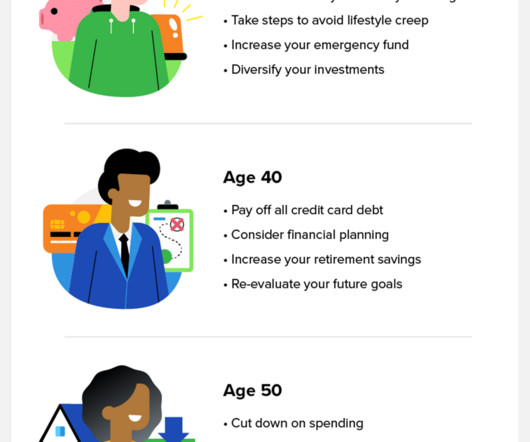

Estate planning is commonly viewed as a dry subject that most people lack interest in or postpone tackling until much later in life. Estate planning is one of those things we think is better to tackle during our retirement. It changes constantly, and can upend at any given moment. Here’s estate planning 101.

Let's personalize your content