How Do Secured Cards Help You Improve Your Credit Score?

Credit Corp

DECEMBER 13, 2023

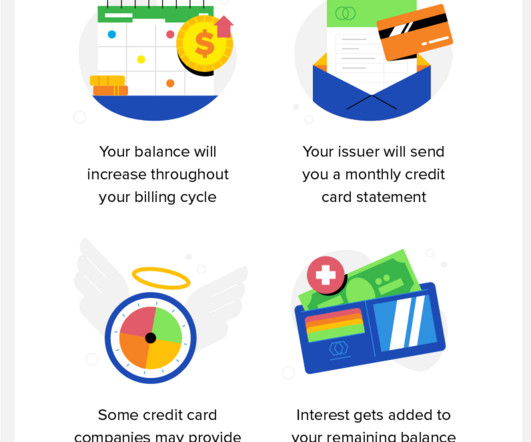

Secured credit cards are designed to help individuals improve their credit history and score. However, these cards differ from traditional unsecured cards in a few ways, and it’s important to understand all the details before you apply for a secured card. What Is a Secured Credit Card?

Let's personalize your content