20+ Illuminating Credit Card Debt Statistics for 2023

Credit Corp

OCTOBER 6, 2023

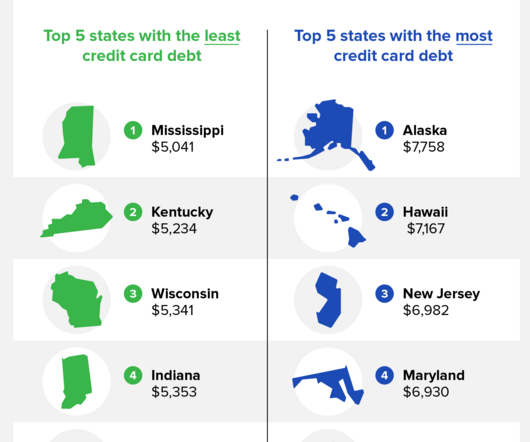

The average household credit card debt in America is $9,654, and the states with the largest amount of credit card debt are Alaska, Hawaii, and New Jersey. Between the first quarters of 2022 and 2023, The Federal Reserve Bank of New York reported that the credit card debt in America rose by $145 billion.

Let's personalize your content