Bankruptcy and Divorce: Should I File Before or After?

Sawin & Shea

JUNE 14, 2023

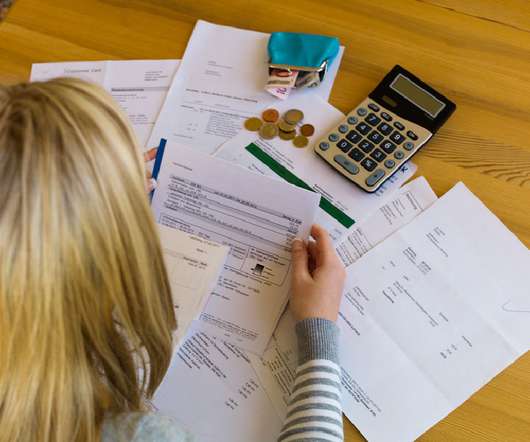

Because so many struggle financially after divorce, it’s common for individuals to declare bankruptcy before or after their marital dissolution. Here’s what you need to know about bankruptcy and divorce. Should I File Bankruptcy Before or After Divorce?

Let's personalize your content