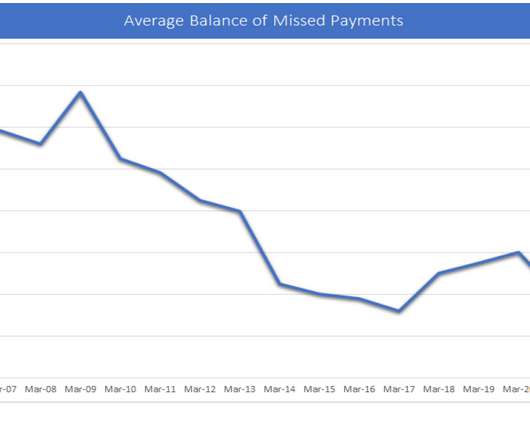

Tech-Enabled Collection Platform Raises $10M

Account Recovery

MARCH 31, 2022

January, more commonly known in the industry as Debtsy, has raised $10 million to help it achieve its goal of becoming a “tech-enabled collections agency service that collects the debt on behalf of creditors in a civilized way,” according to a published report.

Let's personalize your content