13 Ways You Can Make Money

Dear Debt

JULY 29, 2020

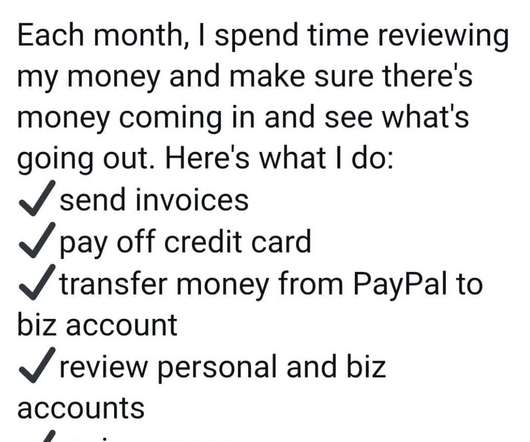

A major concern for many of us is money.… … Related Posts: 10 Signs You Have a Toxic Relationship With Credit. 5 Gifts for the Money Nerds in Your Life. The post 13 Ways You Can Make Money appeared first on DEAR DEBT. Dear Debt, We're Here Again.

Let's personalize your content