Debt recovery and collection look quite different in 2022 than it did ten, five, even just a year ago: new channels to reach consumers, larger data sets to analyze, complex regulations that can vary state by state, and so much more.

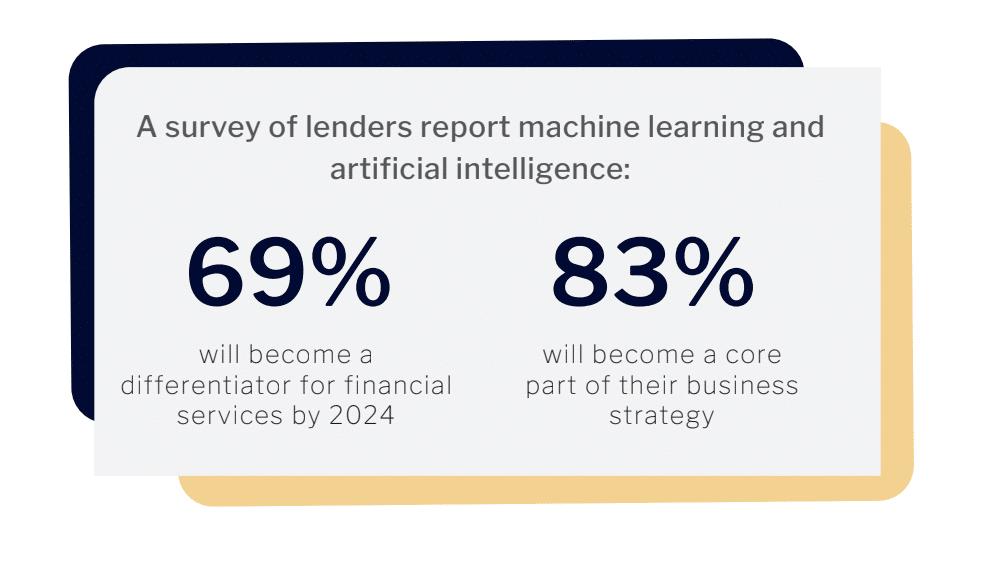

So when it comes to deciding the best way to engage consumers and effectively recover debt, has your strategy evolved to keep up? Machine learning, artificial intelligence, data science—these terms are thrown around a lot, and for good reason.

But how does it tactically improve the experience for both lenders and members?

Decoding Machine Learning for Debt Collection and Recovery

To help decipher real differences between a machine learning strategy versus the traditional call-and-collect, we have designed a highly visual guide to cut through the jargon and help you understand the basics of machine learning in collections. Decoding Machine Learning for Debt Recovery and Collection provides straightforward definitions, clear diagrams, and bottom line benefits make this eBook your at-a-glance guide to machine learning in debt collection.

From delivering a better experience in-line with what consumers expect from businesses to streamline communications, machine learning has gone from a “nice to have” to a “must have” for collection efforts.

Upgrade Debt Recovery & Collection With HeartBeat

Although this type of technology is a step in the right direction, it’s only one step forward—your debt collection strategy can go even further with TrueAccord’s patented decision engine, HeartBeat.

Integrating machine learning into your practice is certainly important—but how does this technology know what the best choice is to engage all of your delinquent accounts now and in the future?

Say hello to HeartBeat, our intelligent decision engine, and say goodbye to missed debt recovery opportunities left on the table by basic machine learning models. See exactly how HeartBeat upgrades your collection strategy in our new eBook, Upgrade Debt Recovery & Collection With HeartBeat—the more in-depth companion piece to our visual guide to machine learning (detailed above).

While HeartBeat utilizes machine learning in its decision-making process, it is not limited to it. This decision engine is continuously evaluated for performance, and adjusted to align with the current economic situation, changes in consumer behavior, and updates to compliance rules.

If you are switching from a more traditional outbound approach then a basic machine learning model can provide a short-term lift in recovery rates, but will hit a dead end when it comes to optimizing, adapting, and improving over time. HeartBeat is set up for the long game and recovers more because of it.

Elevate Engagement, Recover More

Together, these two companion eBooks, Decoding Machine Learning for Debt Recovery & Collection and Upgrade Debt Recovery & Collection With HeartBeat, serve to be the ideal introduction into machine learning in debt collection and then a deeper look beyond the basics to see what even more advanced technology can do for your recovery operation.

Discover how an intelligent, digital-first collection strategy drives overall improved performance, better member experience, and the more effective recovery of delinquent funds—without implementing more manual processes or adding headcount to your team.