Simplicity Tough Guy Contest

SimplicityCollectionSoftware

APRIL 11, 2017

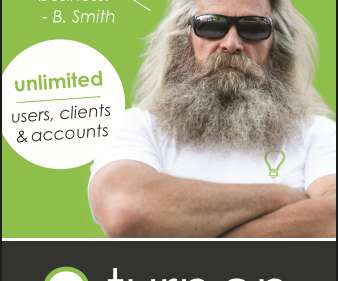

Help us name our new “TOUGH GUY” Our new “tough guy” ads that will be circulating the web and traditional marketing avenues for the next little while. In an effort to revamp our marketing ideas and techniques, this tough guy was born. Since that time, we have grown quite attached to him and his vision for our company and the collection industry in general.

Let's personalize your content