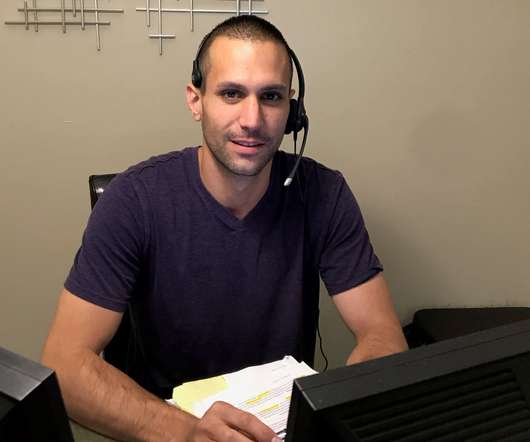

A personal approach during these times

American Profit Recovery

JULY 14, 2020

By Derek: Approximately four months ago, our company made the decision to close the office due to Covid-19, and provide all the employees with computers so they could continue to work from home. It was a drastic change at the time. Everyone was uncertain of what the future held for us, as well as what issues may arise from the switch to working from home.

Let's personalize your content