Suit Totals Drop in February While Complaint Numbers Keep Rising: WebRecon

Account Recovery

APRIL 5, 2022

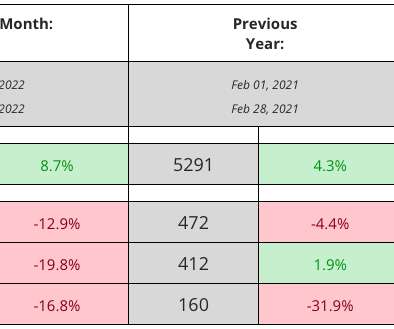

The number of lawsuits alleging violations of the Fair Credit Reporting Act, Fair Debt Collection Practices Act, and Telephone Consumer Protection Act all took a nosedive in February, compared with a month earlier, according to data released last week by WebRecon. Of particular note, the number of TCPA lawsuits through the first two months of … The post Suit Totals Drop in February While Complaint Numbers Keep Rising: WebRecon appeared first on AccountsRecovery.net.

Let's personalize your content