Your credit score is an important aspect of your financial health and is oftentimes used by lenders, landlords, and even employers to determine your creditworthiness. It’s crucial to keep track of your credit score regularly, but many people are hesitant to check it because they’re afraid it will have a negative impact.

Fortunately, there are several ways to check your credit score without hurting it, and in this article, we’ll explore some of the most effective ways to do it. Whether you’re applying for a loan or simply want to stay on top of your credit score, these tips will help you access your credit information without causing any harm.

In This Piece:

- Can Checking Your Credit Score Hurt It?

- Hard vs. Soft Inquiries

- How to Check Your Credit Score without Penalties

- Why You Should Check Your Credit Score

- FAQs

- Improve Your Credit with Credit.com

Key Findings:

- There are many ways to check your credit for free and without penalty

- Personally checking your credit score is considered a soft inquiry and won’t hurt it

- A hard inquiry, which is when a lender checks your credit report, could slightly lower your score

- If possible, avoid authorizing too many hard inquiries in a short period to prevent negatively impacting your credit score

Can Checking Your Credit Score Hurt It?

Checking your credit score will not hurt it. When you check your credit score, it is considered a “soft inquiry,” which means it does not negatively impact your score.

However, if a lender or creditor checks your credit score as part of a credit application or loan, it is considered a “hard inquiry,” which can potentially lower your score by a few points. Remember that while a few points may not seem like a lot, they could make a difference in whether or not you get approved for credit and what interest rate you receive.

Therefore, it’s a good idea to only apply for credit when you need it to avoid hard inquiries on your report and to monitor your credit score regularly to catch any errors or fraudulent activity.

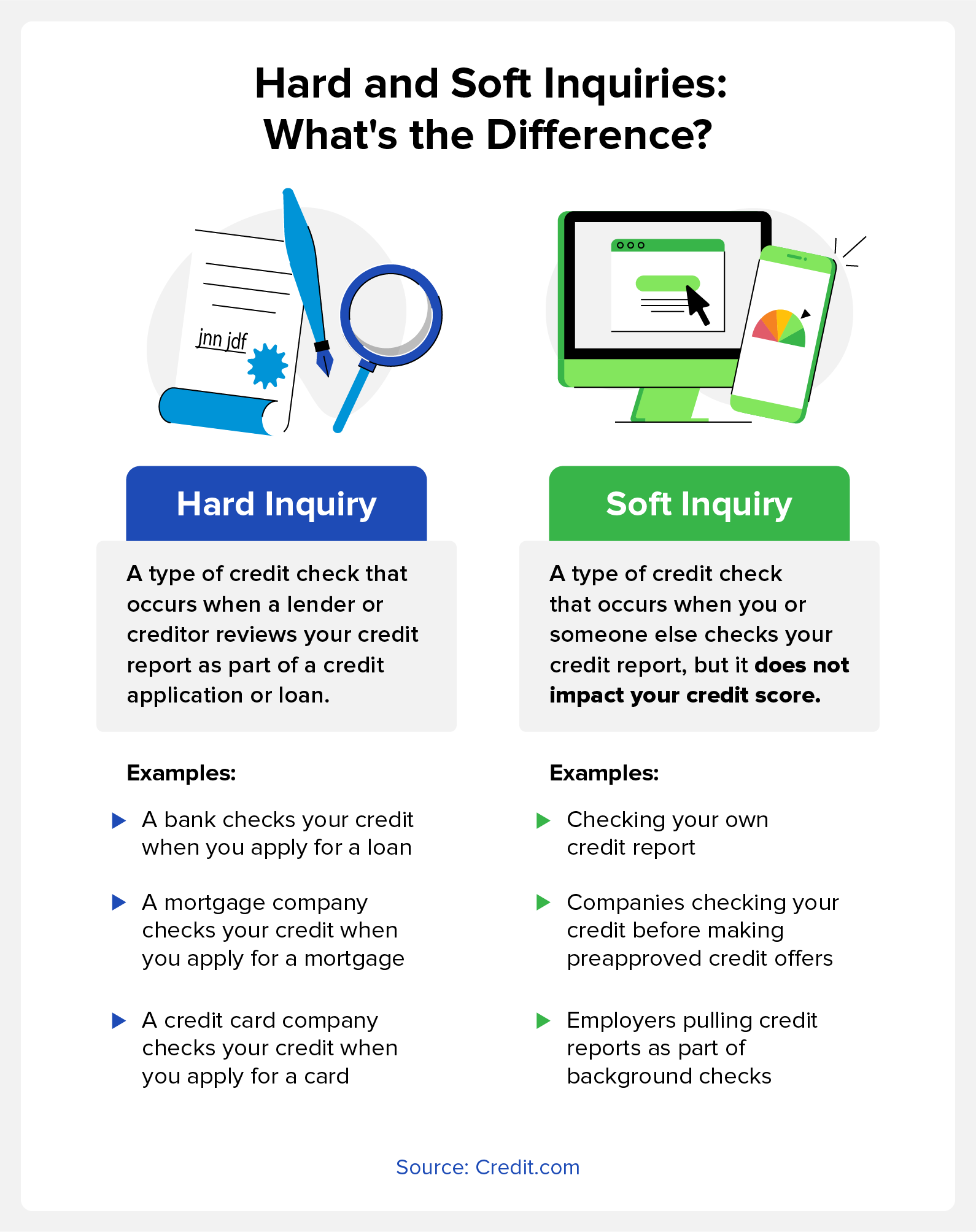

Hard vs. Soft Inquiries

Soft inquiries have no impact on your credit and can be done anytime. Hard inquiries, also known as hard pulls, are typically made by lenders and other financial institutions and can harm your credit score. Below we’ll outline the differences between the two and give examples of when each inquiry might appear on your report.

What’s a Hard Inquiry?

A hard inquiry is a credit check that occurs when a lender or creditor reviews your credit report as part of a credit application or loan. Hard inquiries are sometimes called “hard pulls,” and they typically occur when you apply for a new credit card, a personal loan, a mortgage, or other types of credit.

Hard inquiries can lower your credit score by a few points, unlike soft inquiries. This is because multiple hard inquiries within a short period can signal to lenders that you are actively seeking credit, which could be a sign of financial instability.

Remember that hard inquiries typically can exist on your credit report for up to two years, but their impact generally diminishes over time.

Hard inquiry examples:

- A bank checks your credit when you apply for a loan

- A mortgage company checks your credit when you apply for a mortgage

- A credit card company checks your credit when you apply for a card

What’s a Soft Inquiry?

A soft inquiry is a credit check that occurs when you or someone else checks your credit report, but it does not impact your credit score. Soft inquiries can appear for a variety of reasons, such as when you check your credit score or when a potential employer checks your credit as part of a background check.

Soft inquiries may also occur when lenders or creditors check your credit report for preapproval offers or when you check your credit report for monitoring purposes.

The key difference between soft inquiries and hard inquiries is that soft inquiries do not affect your credit score or creditworthiness, while hard inquiries can potentially lower your score by a few points.

Soft inquiry examples:

- Checking your credit report

- Companies checking your credit before making preapproved credit offers

- Employers pulling credit reports as part of background checks

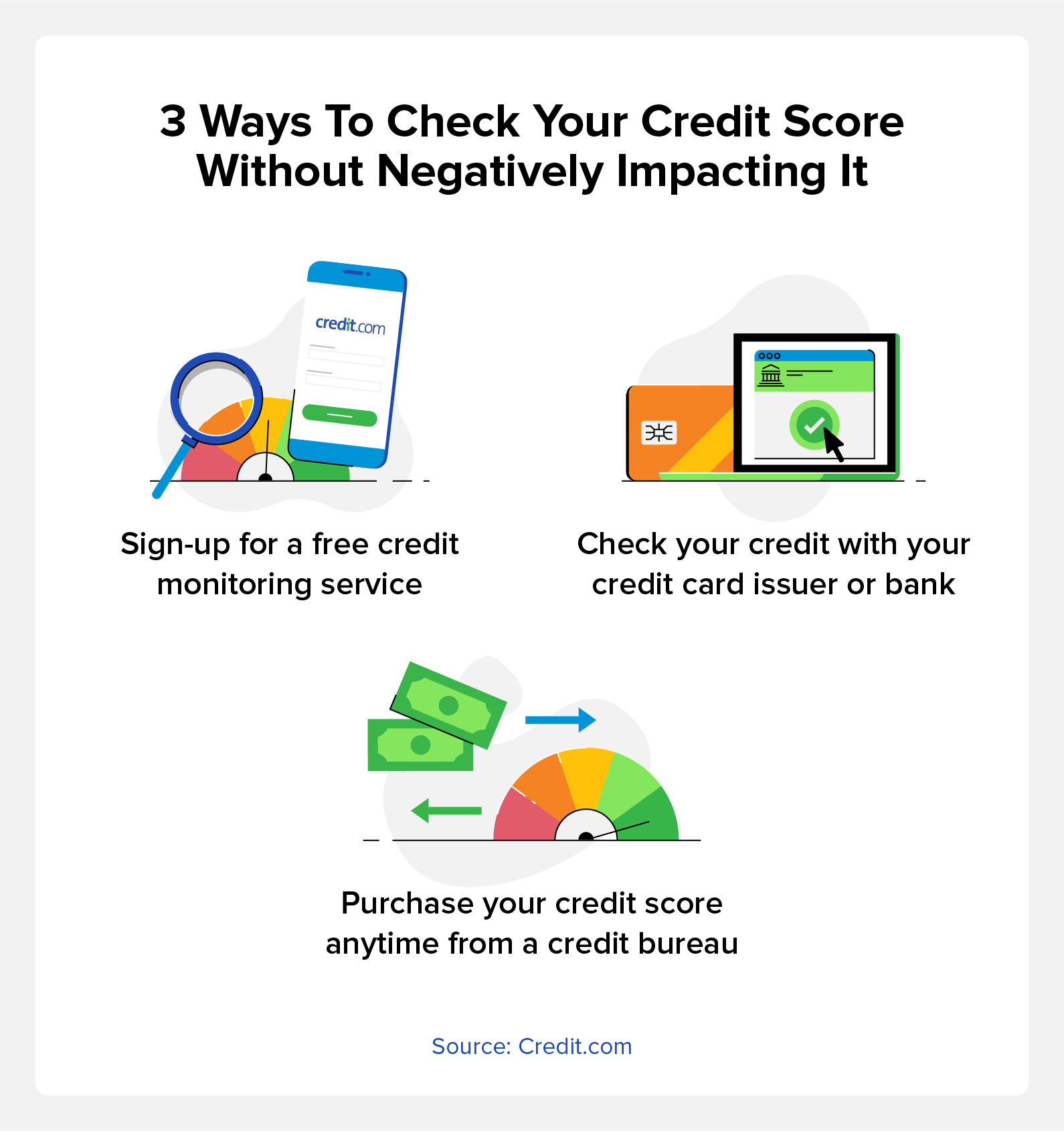

How to Check Your Credit Score without Penalties

Checking your credit score is an important step in managing your credit and overall financial health. Fortunately, you can check your credit score without any penalties or negative impact on your credit report. Here are a few ways to check your credit score without hurting it.

Use a Free Credit Monitoring Service

There are many free credit monitoring services like Credit.com that allow you to check your credit score and report without any penalties. These services will typically provide you with regular updates on any changes to your credit report and alerts for any suspicious activity or potential fraud.

Check with Your Credit Card Issuer or Bank

Some credit card issuers and banks will provide free credit scores to their customers. Check with your financial institution to see if they offer this service and how you can access your score.

Purchase a Credit Score from a Credit Bureau

If you need to check your credit score more frequently than once a year, you can purchase your credit score directly from one of the three major credit bureaus. Be sure to read the terms and conditions carefully, as some credit bureaus may offer a free trial but then charge a fee if you do not cancel within a certain time frame.

Additional help: Request a Free Credit Report

Federal law entitles you to one free credit report per year from each of the three major credit bureaus or through AnnualCreditReport.com:

You can request your credit report online, by phone, or by mail. While your credit report does not include your credit score, it provides a detailed overview of your credit history and can help you identify any errors or issues impacting your credit score.

Why You Should Check Your Credit Score

Regularly checking your credit score is essential for maintaining good financial health. Your credit score is a numerical representation of your creditworthiness and can be used by lenders, landlords, and even potential employers to determine whether or not you are a reliable borrower.

By keeping tabs on your credit score, it can give you clues as to whether your credit report is accurate and up-to-date, and if necessary, allow you to take any necessary action to improve your credit health. Additionally, checking your credit score can alert you to any fraudulent activity on your accounts, allowing you to take action quickly and mitigate any potential damage to your credit.

In short, regularly checking your credit score is vital to responsible financial management.

FAQs

What Is a Good Credit Score?

A good credit score generally falls within the range of 670 to 739, according to the FICO® credit scoring model, and 661-780, according to the VantageScore scoring model—which are the most commonly used models in the United States.

That said, a good credit score may vary depending on the lender, loan type, and/or creditor you are working with. In general, the higher your credit score, the better your chances of getting approved for loans and credit cards with favorable interest rates and terms.

Where Are Credit Inquiries Reported?

Credit inquiries can be found on your credit report. There are two types of credit inquiries: hard inquiries and soft inquiries. Hard inquiries are initiated by lenders or financial institutions when you apply for credit and are sent to one of the three major credit bureaus. These inquiries can stay on your credit report for up to two years, potentially lowering your credit score.

How Can Your Credit Score Change?

Your credit score can change for various reasons, both positive and negative. One of the most significant factors affecting your credit score is your payment history, including late or missed payments, which can lower your score.

Your credit utilization ratio, the amount of credit you’re using compared to your total available credit, can also impact your score. Keeping your credit utilization low can help improve your credit score.

The length of your credit history, the types of credit you have, and the number of credit inquiries can also affect your score. Other factors that can impact your credit score include opening or closing credit accounts, applying for new credit, and negative marks on your credit report, such as bankruptcy or foreclosure.

It’s important to keep track of your credit score and take steps to improve it if necessary, such as paying bills on time and maintaining a low credit utilization ratio.

Improve Your Credit with Credit.com

Many financial decisions depend on your credit score, and a good score can get you better loans, lower rates, and essentially more financial freedom.

Checking your credit score regularly can help you keep tabs on your financial health and allow you to make the necessary adjustments to improve your score whenever necessary.Credit.com’s credit score services provide you with a free credit score from Experian which updates every 14 days. Take your first steps toward financial well-being by signing up today.

You Might Also Like

March 7, 2023

Credit Score

January 4, 2021

Credit Score

September 29, 2020

Credit Score