Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

The average monthly car payment for new vehicles in the United States is $725, and $516 for used vehicles. New car payments are up 11.5% year-over-year and used car payments are only up 2.2%.

Buying a car is one of the most expensive financial choices aside from buying a new home. This is why it’s helpful to know the average car payment in the U.S. before you decide to purchase. Your credit score, down payment amount and other factors affect your monthly car payments—but is your monthly payment the most important aspect to consider?

Today, we go over the average American car payment as well as other statistics like the total auto loan debt in the United States. We also discuss how the average loan differs based on age and credit score. Most importantly, we discuss how to get low monthly payments and a good price on a vehicle.

Table of contents:

- 2023 Car Loan Statistics Key Findings

- Average Monthly Car Payments by Year

- Average Car Loan Amounts for New and Used Vehicles

- Total Auto Loan Debt in America

- Auto Loans as Percentage of Consumer Debt

- How Much Do Americans Borrow for Car Loans?

- Average Car Loans by Age Group

- Average Car Loan Term by Credit Score

- Car Loans by Lender Type

- 4 Tips to Lower Your Car Payments

2023 Car Loan Statistics Key Findings

Knowing the different statistics for monthly car payments can help you have a better idea of where you stand before purchasing a vehicle. Here are some of the key findings from the most recent data:

- The average monthly car payments for new vehicles is $729 per month, up 24.4% from 2022. [Experian®]

- Average used car payments are only up 1.7% from 2022 at $528 per month. [Experian]

- Those with credit scores of 781 to 850 have the lowest average monthly payments for new, leased and used vehicles. [Experian]

- The average loan amount for new vehicles is $40,657. [Experian]

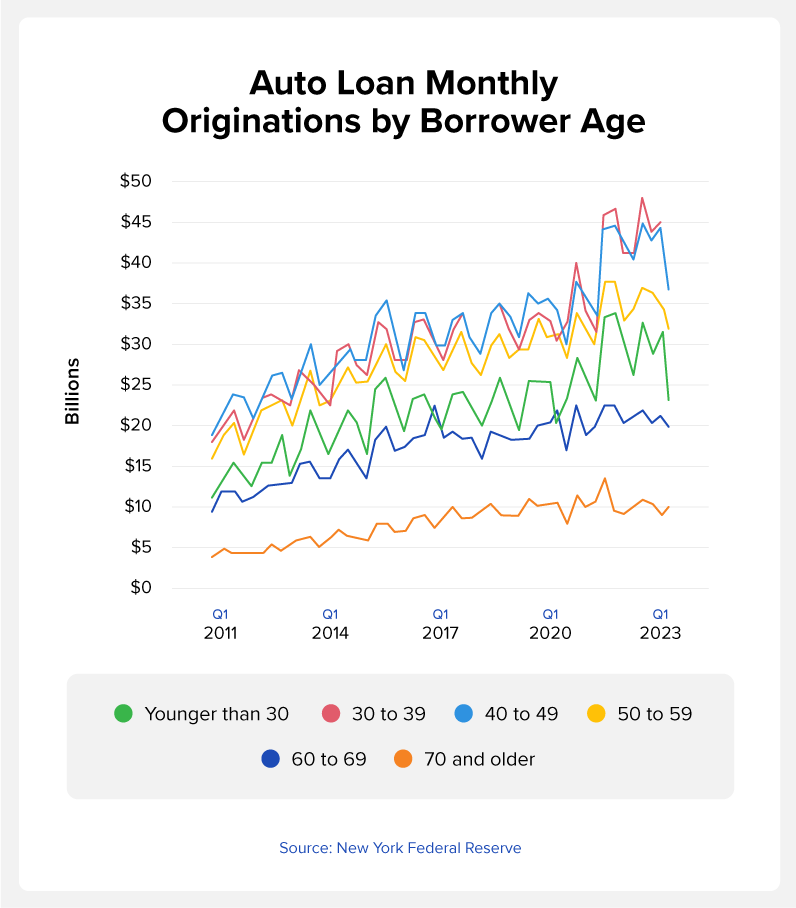

- Americans between 30 and 39 years old took out the most in auto loans in the first quarter of 2023 at $37 billion. [New York Federal Reserve]

Average Monthly Car Payments by Year

As of 2023, the average monthly car payment for new vehicles is $729. This is a 24.4% increase from 2022, according to the second quarter Experian State of the Automotive Finance Market reports. For those leasing vehicles, the average payments are up 5.9%, but the increase for used cars is only up 1.7% from 2022 at $528 per month.

|

Vehicle Type |

2022 Average Monthly Payments |

2023 Average Monthly Payments |

Percentage Change |

|---|---|---|---|

|

New Vehicles |

$625 |

$725 |

11.5% |

|

New Leased Vehicles |

$527 |

$586 |

11.2% |

|

Used Vehicles |

$505 |

$516 |

2.2% |

Average Monthly Car Payment by Credit Score

Your credit score is one of the primary determining factors when it comes to your ability to acquire a loan as well as what your average monthly payment will be. According to recent data, if you have a subprime credit score between 501 and 600, your monthly payments are roughly $70 higher than someone with a high score. Fixing your credit score is one of the best ways to lower your payments when buying a new or used vehicle.

|

Credit Score |

New vehicles |

New leased vehicles |

Used vehicles |

|---|---|---|---|

|

All |

$742 |

$597 |

$528 |

|

781 to 850 (Super Prime) |

$694 |

$621 |

$523 |

|

661 to 780 (Prime) |

$736 |

$612 |

$543 |

|

601 to 660 (Nonprime) |

$769 |

$591 |

$542 |

|

501 to 600 (Subprime) |

$767 |

$563 |

$523 |

|

300 to 500 (Deep Subprime) |

$744 |

N/A |

$508 |

Average Car Loan Amounts for New and Used Vehicles

The amount you need to borrow to buy a new or used car is higher than normal due to the COVID-19 pandemic. Although the world appears to be back to normal, during the height of the pandemic, there were many supply chain shortages and factory shutdowns. Due to supply and demand, this made the price of vehicles higher than normal. Although people are still trying to get their finances back on track post-COVID, we’re still experiencing the effects as the world recovers.

|

Credit Score |

New vehicles |

Used vehicles |

|---|---|---|

|

All |

$40,068 |

$25,041 |

|

781 to 850 |

$36,663 |

$27,303 |

|

661 to 780 |

$42,438 |

$28,402 |

|

601 to 660 |

$43,807 |

$26,527 |

|

501 to 600 |

$40,746 |

$23,065 |

|

300 to 500 |

$36,690 |

$19,912 |

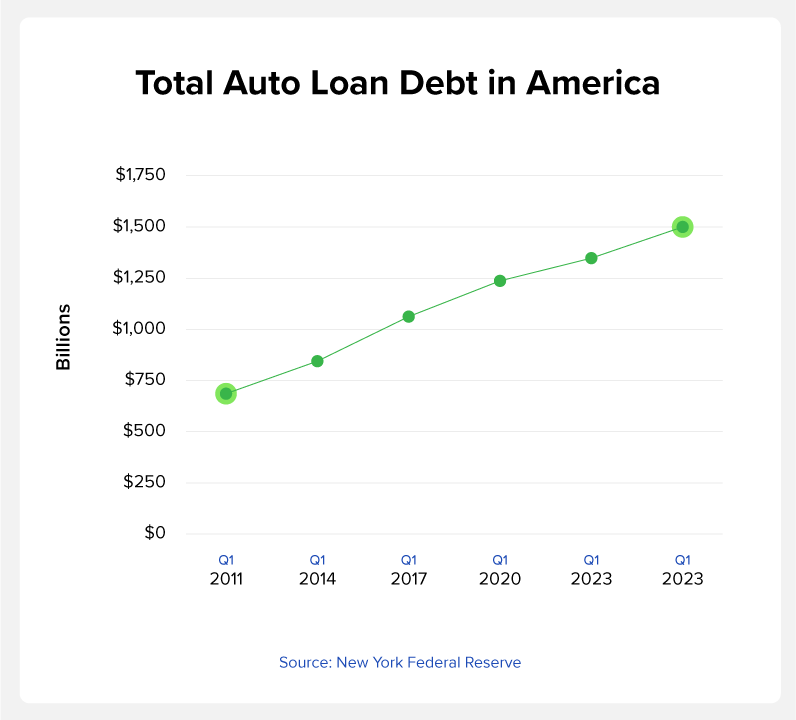

Total Auto Loan Debt in America

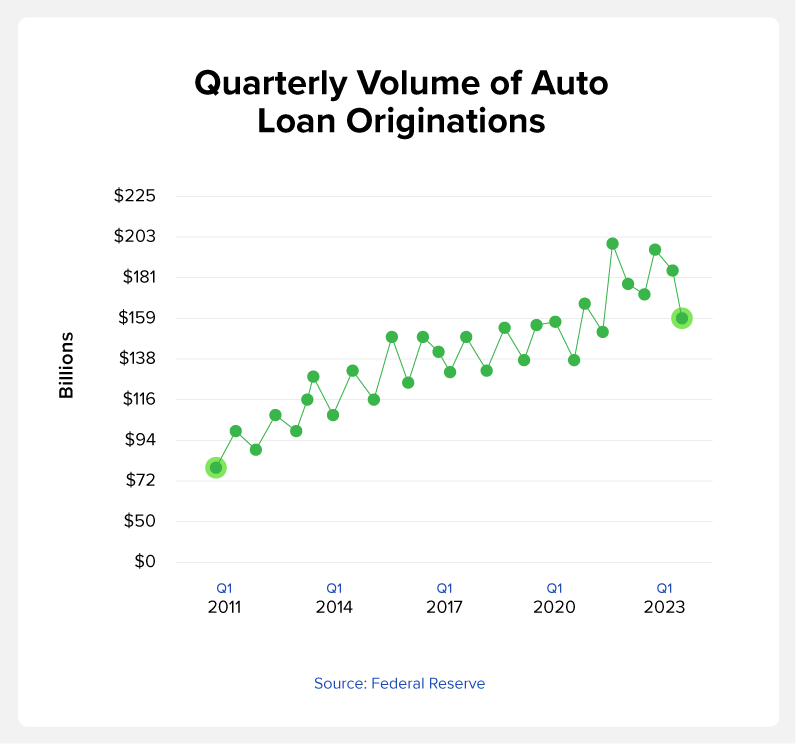

During the first quarter of 2011, the total auto loan debt in America was close to $700 billion. Since then, it’s more than doubled and was over $1.5 trillion by 2023. Not only are vehicle prices continuing to rise over the years, but part of the overall debt may be due to more people having access to auto financing as well.

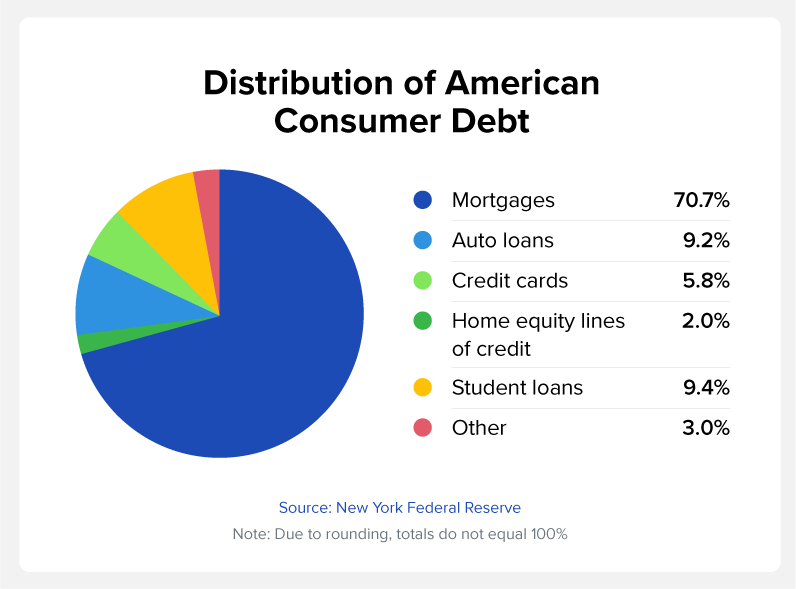

Auto Loans as Percentage of Consumer Debt

As mentioned earlier, buying a vehicle is one of the largest purchases you’ll ever make. Millions of Americans are in debt, and a lot of this comes from auto loans. The average American credit card debt is only 5.8% of consumer debt, but auto loans are the third largest portion at 9.2% of consumer debt. The two largest amounts of debt come from mortgages and student loans.

How Much Do Americans Borrow for Car Loans?

Each quarter, Americans borrow money to purchase new and used vehicles. In 2011, Americans borrowed a little over $72 billion during the first quarter. As you can see in the chart below, the number rises and falls over the years, but as of the first quarter of 2023, the quarterly total is close to $159 billion. This is lower than the third quarter of 2022, when it was over $181 billion.

Average Car Loans by Age Group

The age group that takes out the largest auto loans is those between the ages of 30 and 49. During the first quarter of 2023, Americans between 30 and 39 took out about $37 billion in auto loans, and those 40 to 49 took out $36.5 billion. The lowest borrowers are younger people ages 18 to 29 as well as the older age group of 50 to 59.

Average Car Loan Term by Credit Score

The loan term of your car is the length of the loan if you’re making minimum monthly payments. The loan term is shorter when you make extra payments or larger payments. Based on the recent data from Experian, people with credit scores of 601 to 660 have the longest loan terms for new vehicles. When you have a longer loan term, you’re also paying more in interest fees, which you can see by using a simple loan calculator.

|

Credit score |

New vehicle loans (in months) |

New leased vehicles (in months) |

Used vehicle loans (in months) |

|---|---|---|---|

|

Overall average |

70.5 |

35.88 |

66.11 |

|

781 to 850 |

61.6 |

35 |

64.7 |

|

661 to 780 |

70.15 |

35.91 |

68.41 |

|

601 to 660 |

74.20 |

36.30 |

68.34 |

|

501 to 600 |

73.80 |

36.31 |

66.27 |

|

300 to 500 |

72.79 |

N/A |

62.85 |

Car Loans by Lender Type

When purchasing a new or used vehicle, you have a variety of options for lenders. For new vehicles, most people use dealer financing, which is 54% of new car loans. Used vehicles have more of a mix with people using banks, credit unions and other options. “Buy here, pay here” lenders typically have the highest interest rates and market toward people with poor credit.

4 Tips to Lower Your Car Payments

If you’re in the market for a new car, there are ways that you can lower your car monthly car payments. Knowing these tips before walking into the dealership can help you create a plan. Below, we list four ways to lower your monthly payments:

- Put down a larger down payment: Your monthly payments are based on your overall loan amount. When you make a larger down payment, you have lower monthly payments.

- Trade in your old vehicle: If you don’t have the money for a larger down payment, your old vehicle has a value the dealer applies to lower the loan amount. You can also trade in your vehicle and make a larger down payment.

- Extend the loan term: By opting for a longer loan term, your monthly payments will be less.

- Improve your credit: Improving your credit score is one of the best ways to lower your monthly payments because you’ll likely get a better interest rate, which also decreases the total amount of a vehicle.

When buying a vehicle, keep in mind that although lower monthly payments are helpful, the more important factor is the overall cost of the car. A longer loan term may lead to lower monthly payments, but you may pay thousands more for the car due to interest fees.

How Your Credit Score Affects Your Car Payments

Your credit score is a determining factor when getting a car loan, so it’s beneficial to improve your score before getting an auto loan. The average car loan interest rate for those with low credit scores can be 2% to over 13% more than someone with a good credit score.

If you’re unsure of your credit score, get a copy of your free credit report card to find out. You can also sign up for ExtraCredit® and receive additional credit reporting, which may help you know where you need to work on your credit.

You Might Also Like

October 20, 2020

Auto Loans

July 20, 2020

Auto Loans