Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

The primary credit scoring models are FICO® and VantageScore®, and both are equally accurate. Although both are accurate, most lenders are looking at your FICO score when you apply for a loan.

There’s a lot to learn about credit scores and credit reports and having more than one credit score can get confusing. When you don’t know which credit score and credit report is the most accurate, it can be difficult to know if you’ll qualify for a loan or the state of your credit health.

By understanding the different credit scores, you can save time and protect your credit. Each time you apply for a line of credit or a loan, it can lower your credit score, so it’s best to know the accuracy of your credit score before filling out applications.

Here, you’ll learn about the different credit scoring models, which score lenders use the most, and how to properly check your score.

What Is the Most Accurate Credit Score?

Although you may have different scores, they’re equally accurate based on the specific scoring model.

As the Consumer Financial Protection Bureau explains, “A credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts.”

Based on the information from your credit report, the credit bureaus give you a three-digit credit score. Two primary companies give you a score based on this information, but they weigh the information differently.

As long as the information on your credit report is accurate, your score will also be accurate. The only time your score may be inaccurate is if there is an error on your credit report, which you’ll need to challenge to request to have it removed or corrected.

Why Are There Different Types of Credit Scores?

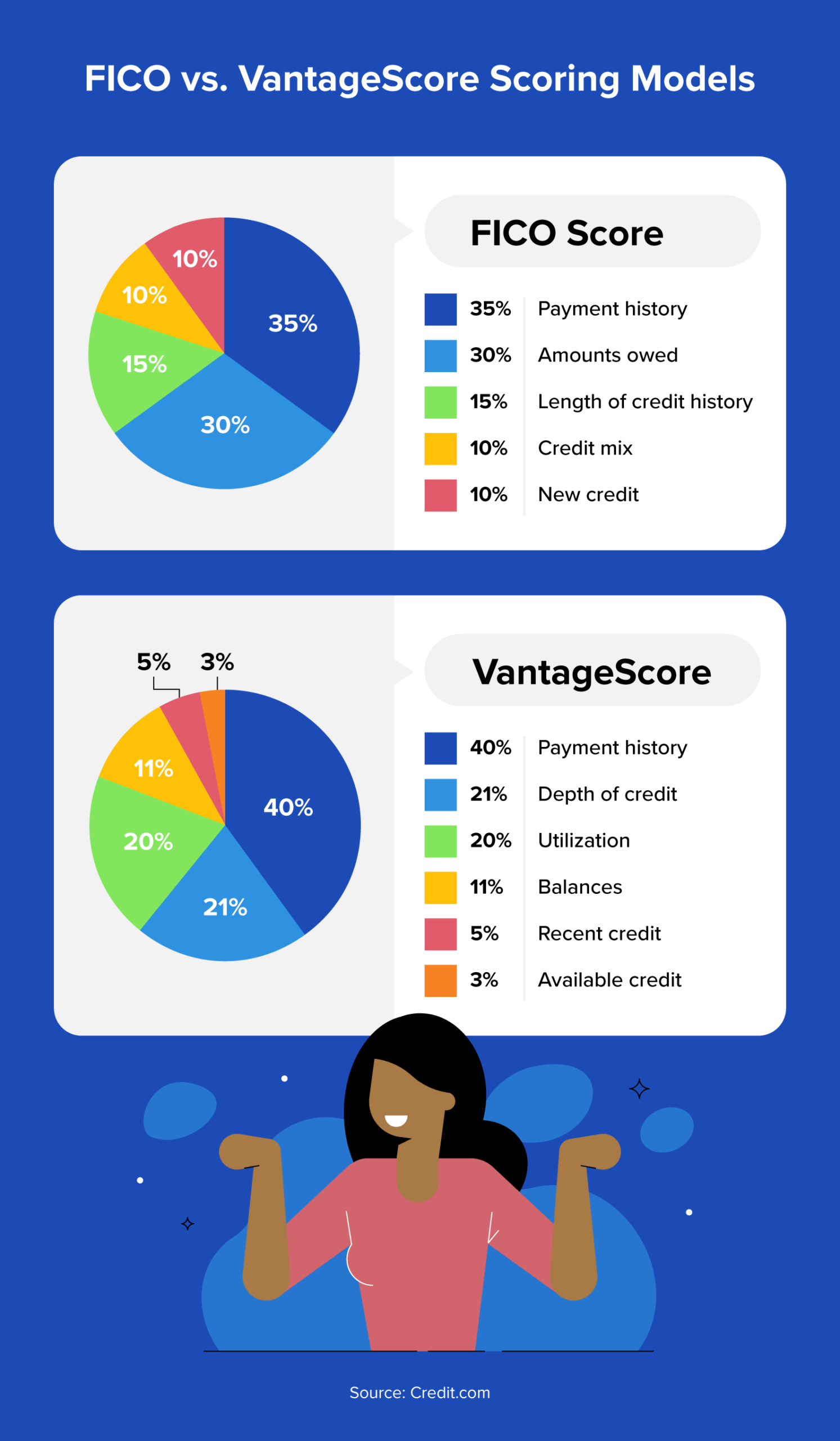

There are two primary scoring models, and both may give you a different score. The main scoring model is through FICO, and the other common scoring model is VantageScore. Next, we’ll break down both scoring models so you have a better understanding of their similarities and differences.

FICO Scoring Model

FICO is a division of Fair Isaac and is the original company that created credit scores to help lenders assess risk in the 1960s. Based on five metrics on your credit report, FICO gives you a score that lenders use to get an idea of how likely you are to repay a loan.

The following are the five factors FICO uses for their model as well as how much they’re weighted:

- Payment history: 35%

- Amounts owed: 30%

- Length of credit history: 15%

- Credit mix: 10%

- New credit: 10%

As you can see, the FICO model gives the most weight to how well you make your payments on time. The second most important factor is amounts owed, or known as credit utilization, and it represents how much you owe versus your overall available credit. They’re also looking at how much experience you have managing credit, the types of credit you have experience with, and how often you apply for new lines of credit or loans.

VantageScore Scoring Model

VantageScore 3.0 is the current version of the VantageScore scoring model. Like FICO, VantageScore is a company that gives you a credit score based on criteria from your credit report. The three major credit bureaus Equifax®, TransUnion®, and Experian® own VantageScore, and it was created in 2006 to give more people access to a credit score.

You’ll notice that VantageScore and FICO have similar scoring models but weight the scoring factors differently:

- Payment history: 40%

- Depth of credit: 21%

- Utilization: 20%

- Balances: 11%

- Recent credit: 5%

- Available credit: 3%

VantageScore also has one more scoring factor than FICO, and it’s for balances. This is the total amount of recently reported balances you owe, including delinquent balances.

Which Credit Score Is Used Most by Lenders?

Many consider the FICO score the more important to pay attention to. FICO states that the majority of lenders prefer the FICO scoring model, and FICO’s website shows that 90% of lenders use their scoring model.

Which Credit Bureau Is Most Accurate?

In addition to the two primary scoring models, you will also find different scores with each credit bureaus. With Experian being the largest credit bureau, many people wonder how accurate the Experian credit score is. Much like the scoring models, your score is equally accurate with each of the individual bureaus based on the information reported to your credit report for that bureau.

Three Reasons You Receive Different Credit Scores

Now that you have learned that your score should be accurate regardless of where you check, there may be some reasons why your credit scores differ. While slight differences in your score may be completely normal, there may also be an issue you’ll need to investigate.

The following are some common reasons you may receive different scores:

- Different processing dates: The credit bureaus update your score regularly based on new information from your credit report. Each one updates the score on different dates, so you may just need to wait for your score to update with a particular bureau.

- Different scoring models: Both FICO and VantageScore have gone through various versions throughout the years. Currently, FICO is on version 10, but FICO 8 is the most common version. VantageScore is on version 4.0, but many still use version 3.0. In some cases, a bureau may use a different version.

- Errors on your credit report: The credit bureaus possibly received different information about payments you made or missed. It’s also possible the error is showing up for all three bureaus. If this happens, you may need to write a credit dispute letter.

How to Check Your Credit Report and Credit Score

One of the best ways you can ensure your credit score and credit report are as accurate as possible is to check them both regularly.

The law entitles you to a copy of your credit report for free under the Fair Credit Reporting Act (FCRA). To receive your free credit report, you can visit AnnualCreditReport.com.

You can check your credit score regularly, in various ways, and it won’t hurt your score. While hard credit inquiries can lower your score, credit monitoring allows you to see your score without harming it, according to the Consumer Financial Protection Bureau.

You can check your credit score for free right here at Credit.com. We also offer a free credit report card, which will give you a more in-depth look at the state of your credit health and what factors are impacting your score most.

How Monitoring Your Score Can Help Keep It Accurate

Many aspects of your financial life revolve around your credit score, so it’s helpful to keep an eye on it as best as possible. Your credit score determines whether or not you receive loans, how much your security deposits are, and where you can rent or buy a home.

A great way to check your credit score regularly is through Credit.com’s ExtraCredit® service. When you sign up for ExtraCredit, you’ll be able to track your FICO score with all three credit bureaus. It also comes with alerts, so you’re the first to know when something changes with your score or when there are potential errors. These are just a few of the features, so sign up for your seven-day free trial today!

Disclosure: Your 7 day trial will begin after agreeing to these terms. After your trial period, your subscription will automatically continue on the same day every month as the day you started your trial membership. The free trial is available for new ExtraCredit customers only. The credit card you provided will be charged $24.99 (plus any applicable tax) on the next business day and monthly; after your trial period unless you cancel. You may cancel at any time by downgrading your service level in your settings or by contacting us at support@credit.com. Dishonored payments will result in an automatic downgrade to the free credit.com product.

You Might Also Like

March 7, 2023

Credit Score

January 4, 2021

Credit Score

September 29, 2020

Credit Score