Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Your credit score may improve if your collection debt is reported to a new credit scoring model—FICO 9®, FICO 10®, VantageScore 3.0® or VantageScore 4.0®. Most creditors still report to old scoring models, so it’s unlikely paying off the debt will improve your credit score.

If you’ve gotten behind on payments to a creditor or lender, your debt could be sent to collections after around 120 days of missed payments. If this has happened to you, your credit score has likely taken a hit and you may be asking, “Does paying off collections improve your credit score?”

Find out what it means to have collections debt, how it affects your credit and what you can do to raise your score after a hit from collections.

In This Piece:

- What Is Collections Debt?

- How Does Collections Debt Affect Your Credit Score?

- Does Paying Collections Help Your Credit Score?

- Is It Worth It to Pay Off Collections?

- How to Improve Your Credit after Collections

- Debt Collections FAQ

What Is Collections Debt?

When you default on a payment, the company you owe may sell your debt to a third-party collection agency. When this happens, it means your debt has gone to collections and debt collectors from the collection agency will now try to contact you for payment.

There are many kinds of debts that can be sent to collections, including:

- Credit card payments

- Student loans

- Medical bills

- Rent payments

- Utility payments

- Auto loans

- Personal loans

- Tax debt

The time it takes the original creditor to transfer your debt to collections varies. Some contracts may have a grace period where you can still pay your debt after it’s due. In other cases, creditors may send you to collections the day after your payment is due.

How Does Collections Debt Affect Your Credit Score?

Collections debt shows up as a negative mark on your credit and, as a result, will significantly harm your credit. This is because collections fall under the category of payment history, which accounts for 35% of your FICO credit score, making it the biggest impact on your score.

The effect on your credit may depend on what your score was to begin with. For example, a score in the 700s may take a more dramatic hit than a score in the 500s.

It also depends on the type of debt you have in collections. Recent changes to medical collection debt mean unpaid bills under $500 won’t be reported to credit bureaus, and paid medical collection debt won’t be reported, thus won’t hurt your credit score either.

The impact of negative collection marks also decreases with time and eventually falls off your report, generally after seven years, as part of the Fair Credit Reporting Act (FCRA).

Does Paying Collections Help Your Credit Score?

Paying off collections can help your credit score if the lender reports to new credit scoring models, including FICO 9®, FICO 10®, VantageScore 3.0® and VantageScore 4.0®. These models ignore collections with a balance of zero, so you’ll see a boost in your score if you pay off collection debt.

However, if your lender reports to older scoring models, which most do, it’s unlikely you’ll see a difference in your score even if you pay the debt, as these models don’t lessen a negative mark from collections regardless of if it’s marked as paid or unpaid.

How to Remove Collections from Your Credit Report

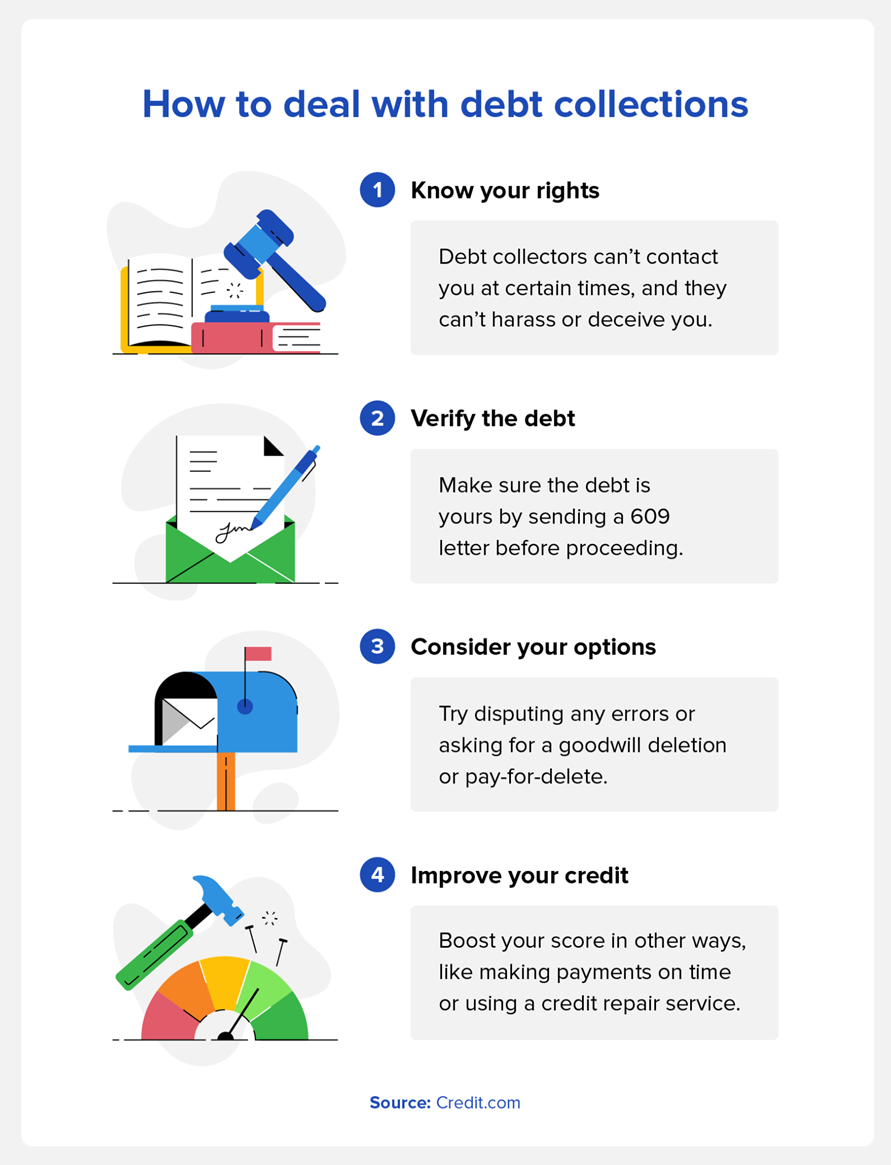

There are a few methods for removing collections debt from your credit report. Keep in mind that results may vary as each individual’s financial situation is different. Here are a few ways you can attempt to get collections removed from your report.

Dispute Errors

You have the right to dispute any items on your credit report that are inaccurate or outdated. Here are the steps to take to find and challenge errors on your credit report:

- Get copies of your credit report from all three bureaus—Equifax®, Experian® and TransUnion®. You can get one free copy per bureau a year at AnnualCreditReport.com.

- Look for mistakes like collections past the statute of limitations or debt that isn’t yours.

- If you find a mistake or need more information, send a 609 letter. This letter requires the bureaus to verify or correct items you’ve called out within 30 and 45 days.

- Once you have proof of an error, you can write a dispute letter asking for the incorrect item to be removed. This can be filed online with the major credit bureaus or mailed.

- Make sure to keep a record of all correspondence with bureaus.

Removing mistakes on your credit report can help raise your credit score, depending on various factors. However, the process of disputing errors can be difficult and long. Consider using a professional credit repair service that has experience working with credit bureaus, especially if you have a lot of inaccurate collection accounts or a more complicated situation.

Ask for a Goodwill Deletion

If you have an otherwise positive credit history and a long-standing relationship with the creditor of your collection, you may be able to receive a goodwill deletion.

This process begins with writing a goodwill letter to the original creditor of the collections, which should include:

- Time with creditor

- Positive items on your credit report

- Intention to stay in good standing

- Request for a line item adjustment

If successful, the creditor will delete the item you’ve highlighted as a gesture of goodwill.

Write a Pay for delete Letter

You may be able to arrange a deal with your collection agency to delete the collection account in exchange for payment. This is done with a pay for delete letter.

Keep in mind that not all agencies accept pay for delete letters, especially banks or larger creditors. Collection agencies tend to sell debts, which means your debt may end up with a new agency where you can try this method again.

To write a pay for delete letter, include the following information in your letter:

- Dates

- Proposed payment amount (can be less than the amount owed)

- Terms of negotiation

Before resorting to this method, make sure the debt is verified as yours with a 609 letter. Also, make sure to get any communication from the collection agency documented in writing and keep a copy of your letter.

Is It Worth It to Pay Off Collections?

While paying off collections may not always improve your credit score, it can have other financial benefits. Additionally, there are potential consequences for not paying collections. Ultimately, the decision depends on your financial situation and goals. Here are some reasons to pay your collection debt:

- Dodge lawsuits: If you don’t pay off your collection debt, the debt collectors may sue you.

- Avoid interest and fees: You may rack up additional interest and fees on this debt.

- Secure future loans: Some lenders won’t work with anyone with collections on their credit report. They can be flexible if you can prove you have paid the debt or a repayment plan is in place.

- Increase credit score: Depending on your circumstances and credit reporting model, you may be able to increase your credit score by paying the debt.

If your debt has already passed the statute of limitations, debt collectors most likely won’t be able to continue asking for repayment or pursue legal action against you.

However, making a payment or a written acknowledgment of the debt could restart that time period. Once the time period restarts, you could be sued for the debt again. So, if you decide to pay the debt, it’s best to pay it all at once instead of partial payments to avoid restarting the statute of limitations.

How to Improve Your Credit after Collections

If none of the above methods for removing collections from your credit report worked for you, there are other ways to improve your credit. Here are some ways to repair your credit after collections:

- Pay on time: Pay your other bills on time to avoid more collection debt and to positively affect your credit.

- Try to keep your credit accounts open: Credit age is an important factor for your credit score, and closing an old account can decrease the average age of your accounts and lower your score.

- Pay down credit card balances: If you have a large credit card balance, paying down that balance can help lower your credit utilization rate and raise your score.

- Think before opening new lines of credit: When you apply for credit, a hard inquiry is made on your report, which lowers your score.

- Use a credit repair service: Professional credit repair companies can help you address errors on your report and find other ways to increase your score.

It’s a good idea to follow these tips even if your collection debt is reported to a newer credit scoring model, as it still may take time to see improvements to your credit score.

Debt Collections FAQ

Have more questions about debt collections? Check out the answers to these common collections questions.

What Are Your Debt Collection Rights?

If you haven’t found out already, debt collectors can be very persistent. It’s important you know your debt collection rights and how a debt collection agency is legally allowed to handle your accounts and communicate with you.

As outlined by the Fair Debt Collection Practices Act (FDCPA), debt collectors have to follow these guidelines:

- Written Notice: Debt collectors must provide written notice with information about your debt within five days of contacting you.

- Time and place: They can’t contact you before 8 a.m. or after 9 p.m. They also can’t contact you at work if you’ve communicated you’re not allowed to take personal calls at work.

- Harass or abuse: Collection agencies can’t yell at you, threaten violence, or use obscene language.

- Deception: They can’t lie about their identity, how much you owe, your legal rights, or any other form of deception.

- Privacy: Debt collectors can receive your contact information (address, phone number, work address) from certain people, but they can’t contact people more than once. They can only contact your spouse, guardian, or attorney.

- Attorney correspondence: If you’re being represented by an attorney, debt collectors may only communicate with your attorney once they’re aware of your representation.

If a debt collector has infringed on any of these rights, you can file a report with your state’s Attorney General’s office or the Federal Trade Commission (FTC).

How Long Will Collections Debt Stay on My Credit Report?

Collections debt stays on your credit report for at least seven years as part of the FCRA, regardless of whether you’ve paid the debt or not.

The debt doesn’t go away necessarily, but the negative item will drop off your credit report eventually, and you can no longer be sued for the debt after the statute of limitation time period passes.

How Many Points Does a Collection Drop Your Credit Score?

A collection debt’s impact on your credit score varies, but generally speaking, it could drop your score significantly. The impact depends on your initial score, with higher scores taking a bigger hit than lower scores. Multiple collections on your credit report could drop your score even more.

How Many Points Will My Credit Score Increase When I Pay off Collections?

Your credit score may not increase at all when you pay off collections. However, if your debt is reported using a newer credit scoring model, your score may increase by however many points were impacted by the collections debt.

It would also depend on the time passed since getting the negative mark. You’re more likely to see a positive increase from paying off the collection if it was recently incurred than a collection you’ve had for six years since the effects on your credit lessen over time.

If late payments are hurting your credit score, you may need a little extra help understanding how your credit is impacted and what you can do about it. Try ExtraCredit to help track your credit score, with other features available to help you work to meet your credit’s full potential.

You Might Also Like

March 7, 2023

Credit Score

January 4, 2021

Credit Score

September 29, 2020

Credit Score