FCRA Claim for “Misleading” Double-Reporting of Debt by Original Creditor and Collection Agency Survives Motion to Dismiss

Troutman Sanders

SEPTEMBER 8, 2023

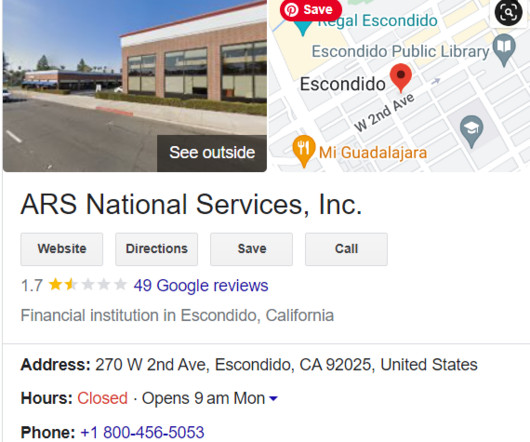

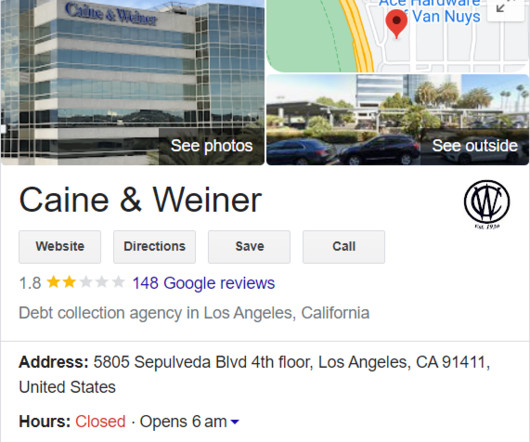

The credit union then assigned the debt to a third-party collection agency. Following the assignment, the collection agency opened its own tradeline for the debt, while the credit union also continued to report the debt.

Let's personalize your content