The average American net worth varies due to many factors, with some people making far more than others. If you’re behind the national average, it may seem difficult to catch up, but whether you have bad credit or a lot of debt, you can still begin building your net worth by learning how to generate passive income.

Passive income is a great way to generate more income, pay down your debt, and start saving and investing for your future. Here you’ll learn what passive income is, as well as different ways to make passive income online and offline. With 25 passive income ideas, there is something for everyone.

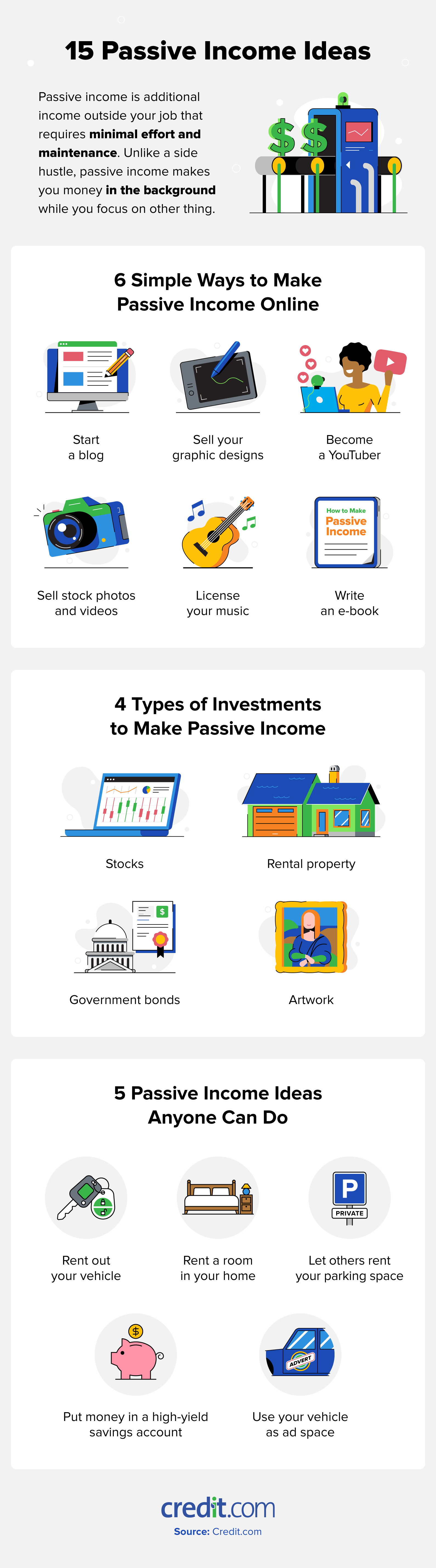

25 Passive Income Ideas:

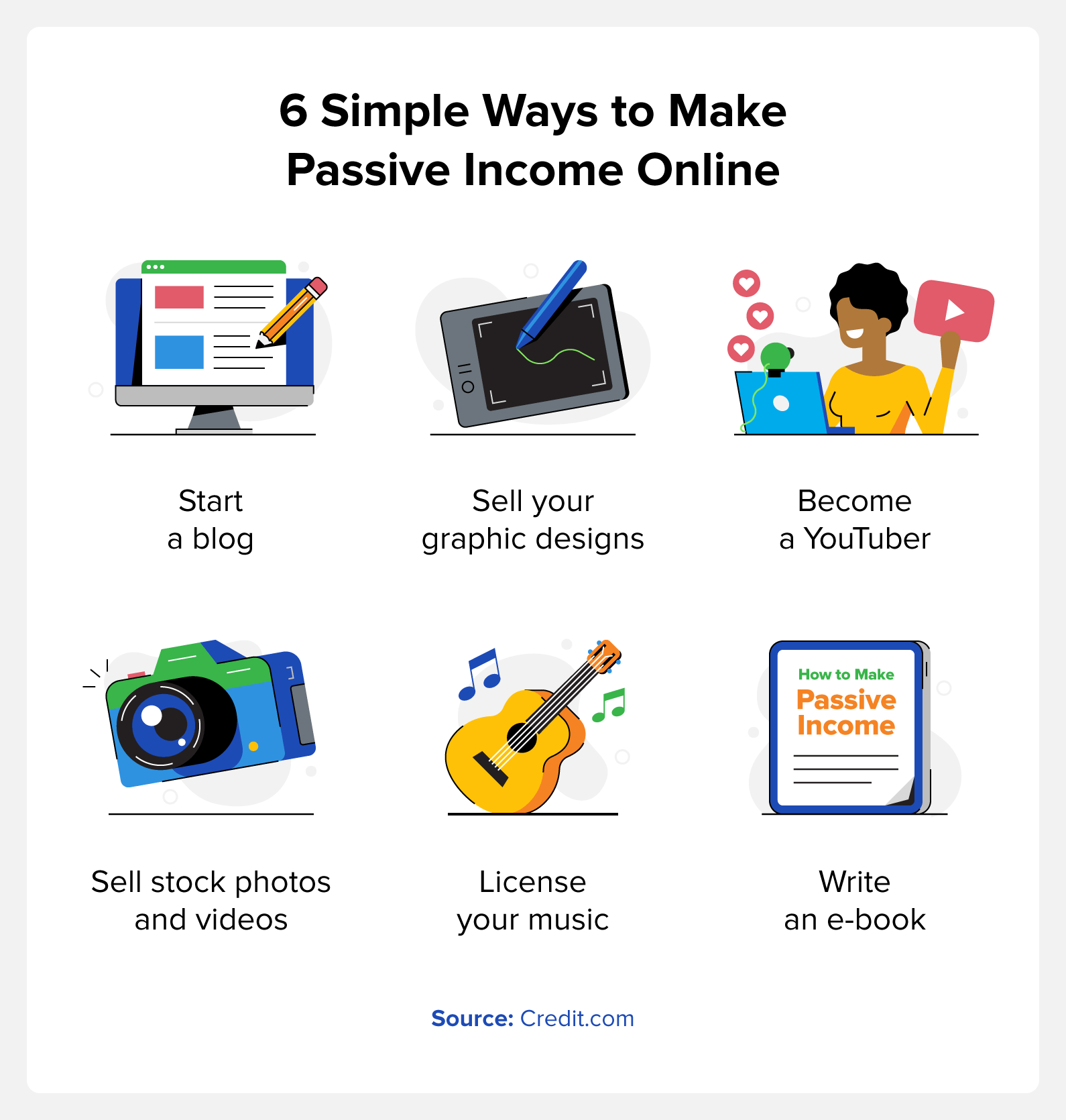

- Write an E-Book

- Start a YouTube Channel

- Try Affiliate Marketing

- Create a Blog

- Sell Stock Photos and Videos

- Create an Online Course

- Make Sponsored Content

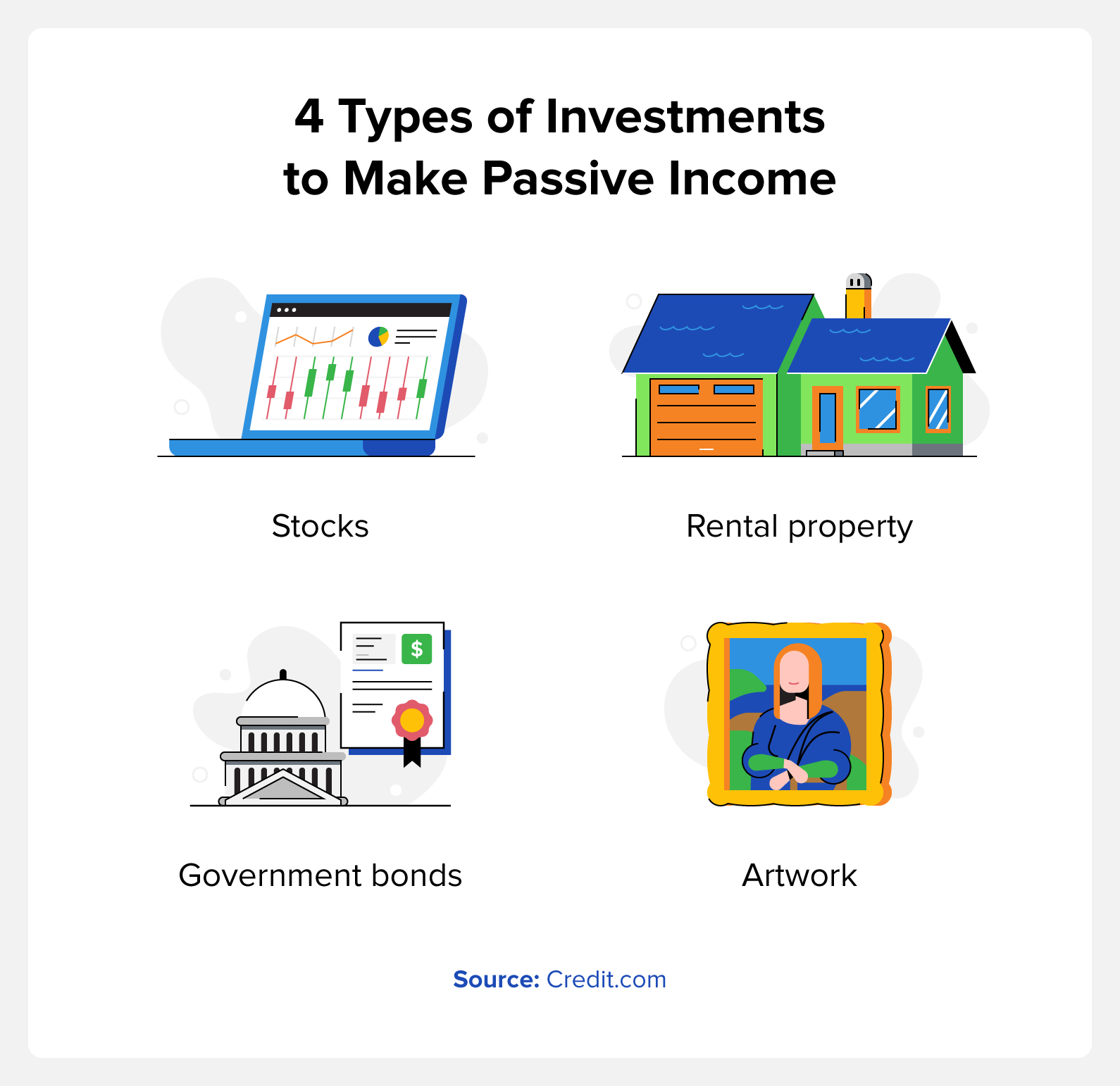

- Invest in Dividend Stocks

- Invest in REITs

- Invest in Index Funds and ETFs

- Try Peer-to-Peer Lending

- Stake Cryptocurrency

- Utilize High-Yield Savings Accounts

- Buy Government Bonds

- Invest in Art

- Buy Property to Rent

- Rent Out a Room in Your Home

- Buy Domain Names

- License Your Music

- Design Custom Products

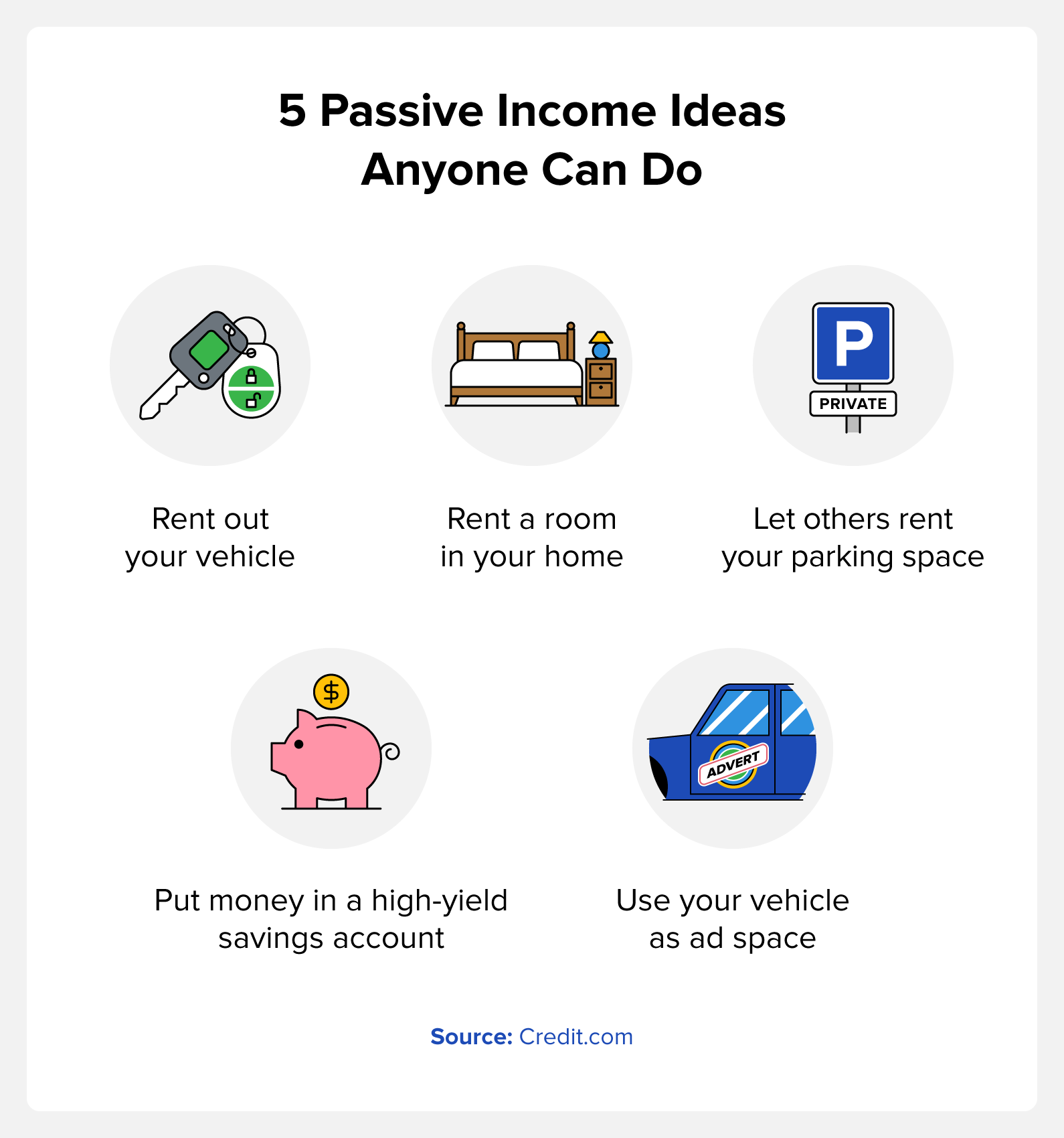

- Rent Out Your Vehicle

- Use Your Vehicle as Ad Space

- Create an App

- Flip Unique Items

- Rent Out Your Parking Space

What Is Passive Income?

Passive income is a type of income that comes from sources other than your regular employment, and involves a more hands-off approach. Passive income isn’t a “get rich quick” scheme, though some companies make big claims about generating passive income without any work. Passive income does take work to set up, but the goal is that you can make money without managing it on a day-to-day basis.

You’ll generally do most of the work by setting up your source of passive income. While it may require some upkeep every now and then, like updating a product or maintaining a rental property, you’ll earn the majority of your income while pursuing other endeavors.

Like other sources of additional income, passive income is taxable, but when done correctly, you can make enough passive income to surpass your tax bill.

1. Write an E-Book

Whether you’re a writer or not, an e-book can be a fantastic way to generate passive income. We no longer live in a world where publishers are the gatekeepers of books, so you can self-publish a book that can generate passive income. Various websites let you self-publish books, like Amazon’s Kindle Direct Publishing, Apple Books, and Barnes & Noble. Some of these sites also offer print-on-demand services for customers who want physical copies.

You can write a nonfiction book if you’re knowledgeable about a certain subject, or you can write fiction if you have an interesting story idea. Although this can generate passive income, self-publishing can require a bit of an investment. You’ll need to pay for an editor and book cover designer, and you may also want to pay for advertisements. But if you can do the cover art and marketing on your own, you may be able to save some money.

2. Start a YouTube Channel

There are many ways to make money using social media, but YouTube is one of the best ways to make passive income. YouTube pays content creators to run ads on their videos. In order to qualify for the YouTube Partner Program, you’ll need at least 500 subscribers, three new videos within the last 90 days, and 3,000 watch hours within the last year. Previously, you needed 1,000 subscribers and 4,000 watch hours, but the policy was updated in June 2023 with lower requirements.

Like other sources of passive income, making money from YouTube will require an up-front investment of time and money. You need a stable internet connection, camera, microphone, computer, and editing software. You also need to make consistent videos to qualify for the partner program. You can eventually generate passive income by making evergreen videos, because people will watch old videos that bring in revenue—and the more videos you have on your channel, the more money you can make.

3. Try Affiliate Marketing

Affiliate marketing is when you share a link to a product or service, and the company gives you a percentage of any sales made through that link. You can share these links on your social media pages, blog, newsletter, or anywhere else that allows you to post a link. Affiliate marketing is one of the best online passive income opportunities, and you can combine it with any other online method we mention in this article.

One of the most popular affiliate link programs is Amazon Associates. Let’s say you have a YouTube channel where you review electronics, and you make a video reviewing a new TV or laptop. If you link to that product on Amazon with your affiliate link, you’ll receive a percentage of the sale each time someone uses your link.

This isn’t only limited to Amazon, either. Many companies offer affiliate links, so it can be advantageous to reach out to companies for products and services you use regularly to see if they have an affiliate program.

4. Create a Blog

There are a variety of ways to make money from writing a blog. Like YouTube, old blog posts can generate passive income even if people read the post months or years after you wrote it. If you create your own website to host your blog, you can integrate Google Ads and use affiliate links to make money online.

Platforms like Substack combine blogs and newsletters, so every time you write a new post, subscribers receive an email. You can have paid subscriptions on Substack, so users pay a monthly fee to read your posts, and you can have free posts that go out to non-paying subscribers as well.

5. Sell Stock Photos and Videos

If you’re a photographer or videographer, you can earn money for your photos and videos. There are many different websites that buy stock photos and videos, like Shutterstock, iStock, and Getty Images. One thing to consider is that the website gets exclusive rights to your images or videos, but on some sites you can make between 15% and 45% in royalties.

6. Create an Online Course

Many people have expertise in a certain area, and utilizing your knowledge and skills to create an online course is a great way to make passive income online. For example, you can create a course for how to knit, how to take amazing photos, or how to program an app. Websites like Kajabi and Teachable allow you to host and sell your courses.

You may need to invest some time and possibly money in marketing your course to ensure you find the right audience. Some course-hosting platforms like Skillshare also categorize courses by topic for better discoverability.

7. Make Sponsored Content

If you start gaining a following on social media platforms or through a blog, you may get the opportunity to do sponsored content. Companies want to ensure they target the right audience, so if you have followers who may buy their product or service, they’re more likely to sponsor a piece of content. This typically means you discuss their product in a video or write about it in a caption.

In order to generate passive income from a sponsored opportunity, the company will give you an affiliate link. This allows you to make money up front for the sponsored content as well as passive income from anyone who uses your link to buy the product or service.

This route for passive income may take some time because companies typically want people to have a decent following before sponsoring content.

8. Invest in Dividend Stocks

Stocks can be a great way to make money while also investing in your future. When you buy a stock, you buy a small portion of a company. If the stock price rises and you sell it at a higher price, you make a profit, but the stock can also drop in price and lose you money. Some, but not all, stocks offer dividends, which pay investors a dividend per share if the company has a profitable quarter.

When the stock pays out dividends, you can receive the payment directly from your brokerage or reinvest the dividends by buying more of the stock. Like other investments, this can compound and turn into a lot of money over time if the company continues to profit. As you invest in dividend stocks, keep in mind the companies can raise or lower the dividend percentage at any time.

Use MarketBeat’s dividend calculator to look up specific stocks and estimate dividend returns.

9. Invest in REITs

Real estate investment trusts (REITs) are another investment opportunity. Rather than investing directly in a property, you can invest in a REIT, which is a company that owns and manages real estate.

Similar to other investments, there is risk that comes along with investing in REITs. For example, there’s a possibility your REIT investments will lose money if there’s a drop in the housing market.

10. Invest in Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) are some of the safest investments because they offer diversification. Rather than investing in one company, index funds and ETFs allow you to invest in multiple companies simultaneously.

Legendary investor and founder of Vanguard John Bogle was a major advocate for index fund investing. More specifically, he advised people to invest in the S&P 500, an index of the 500 largest companies in the United States. ETFs are slightly different because there are higher fees, but they allow you to invest in a group of stocks for a specific industry. For example, ARKK is an ETF that holds shares for companies that work on innovative technology.

There is still a risk when investing in index funds and ETFs, but they are often lower risk than other forms of stock investing.

11. Try Peer-to-Peer Lending

Another way to make passive income is to become your own type of “bank” by doing peer-to-peer lending, sometimes called P2P lending. Banks make money on loans by charging interest to customers, and P2P lending allows you to do the same thing. Websites like Prosper and Funding Circle allow everyday people to lend and borrow money with various interest rates.

12. Stake Cryptocurrency

Cryptocurrency investing is a highly volatile form of investing, making it especially high risk. Some cryptocurrency platforms allow you to “stake” your crypto, which is when you allow the platform to hold your crypto and lend it to other people. Similar to P2P lending, you make money off the interest.

Cryptocurrency lending and trading is also high risk because there is little to no regulation. Crypto platforms like Voyager have been known to offer extremely high returns and then go bankrupt, preventing them from paying back their users. In extreme cases, there are stories of fraudulent activity from crypto platforms. But if you have a high risk tolerance, this form of investing can be incredibly lucrative.

13. Utilize High-Yield Savings Accounts

A safer way to make passive income is to open up a high-yield savings account, which allows you to make money simply by holding it in your account. Banks use customer funds to lend out money, but unlike crypto staking, bank funds are backed by the U.S. government via the FDIC. This means that if, for some reason the bank doesn’t have the money when you want your funds, the government would provide the bank with the money to pay you up to $250,000.

Many banks and financial institutions offer high-yield savings accounts, with some offering an annual percentage yield (APY) of over 4%. So if you opened an account with a 4.5% APY and deposited $1,000, you would have $1,045 after a year.

People maximize their passive income by not touching this money because it compounds each year. So using that same example, in the second year, you would then earn 4.5% of the $1,045 rather than the original $1,000. And if you add to the savings account each month, you can make quite a bit of money over time.

14. Buy Government Bonds

Perhaps the safest way to earn passive income from investing is to buy government bonds. A government bond is basically a loan to the federal government that pays you back the original amount with interest over a certain period. The reason government bonds are so safe is because the government backs them. When buying a stock, it’s possible to lose your money if the company goes out of business. Bonds are safer because as long as the government exists, you’ll make your money back.

Although government bonds are very low risk, they also offer low returns. Depending on various factors, government bonds may offer a 3–5% return over two to 30 years. To put that into perspective, S&P 500 index fund investing offers an average return rate of over 7.5%[1] .

15. Invest in Art

Similar to stocks, you can also invest in artwork. One way to do this is to buy works of art that you believe will increase in value later. If you’re knowledgeable about art and can find pieces selling for below their value that you can sell later for a profit, you can make a bit of money. Websites like Masterworks allow you to buy shares of artwork with other investors so you take on less risk.

16. Buy Property to Rent

Many people generate passive income by purchasing properties to rent. If you can afford the initial investment of buying a single-family home or condo, you can then rent them out to tenants for a profit. For example, if you buy a house and your mortgage is only $1,000, you can make a profit by charging any amount over your mortgage cost.

In order to take advantage of the passive income aspect of renting, you may benefit from hiring an individual or company to manage the property. Property managers collect the monthly rent and take care of maintenance issues for a fee. Should you decide to invest in rental properties, it’s helpful to factor in the cost of potential home repairs before, during, and after tenants live there.

17. Rent Out a Room in Your Home

If you don’t have the money for a down payment or don’t want to take on the risk of purchasing a rental home, you can always make some extra income by renting out a room. If you have a spare room in your home, you can rent it out for a monthly fee. This is a great option for families whose children recently moved out.

You can use websites like Airbnb and VRBO to connect you with renters. Although many people use Airbnb for short-term rentals during vacations, you can also offer long-term rentals through the website. These sites also let you vet renters before they move in, so you have control over who rents the room.

18. Buy Domain Names

Buying domain names is a sort of investing, so it does come with some risk. People and businesses buy domain names to host their websites, so you can purchase a variety of inexpensive domain names in hopes of people buying them from you later for more. You can typically buy domain names for less than $10 through websites like GoDaddy, but if they don’t sell, you’ll need to pay the annual cost to keep the name.

While this may be a risky investment, people have made a lot of money flipping domain names. It was a big money-maker during the “dot com boom” in the 1990s, Help.com sold for $3 million and NFTs.com sold for $15 million in 2023. Many domains don’t sell for millions, but you may still be able to make a decent profit off domain names in high demand.

19. License Your Music

If you’re a musician, you can license your music in a similar way to selling stock photos and videos. Some websites like Music Vine pay musicians 30% for nonexclusive deals or more for an exclusive license. There are also websites like Epidemic Sound that market to YouTubers and filmmakers by offering a subscription service for royalty-free music.

20. Design Custom Products

For those who are artistically inclined, you can make money creating designs and selling them on websites that sell custom products. Websites like Redbubble, Teespring, and Society6 offer print-on-demand services for your artwork. These websites sell a wide range of products like T-shirts, coffee mugs, phone cases, and more. You get a percentage of the sale every time a customer goes to the website and chooses your design for any of these products

If you have old artwork you created in the past or simply feel like creating in your spare time, you can generate passive income as long as your art is hosted on these types of websites.

21. Rent Out Your Vehicle

Services like Uber and Lyft are popular side hustles, but you can make passive income by renting out your vehicle instead. When people are traveling or have their car in the repair shop, they often need a vehicle to get around. Rather than going to a rental car company, they can rent a vehicle through other websites like Turo or Getaround.

22. Use Your Vehicle as Ad Space

In addition to renting out your vehicle, you can make passive income by using your vehicle as ad space.

Websites like Wrapify connect businesses and drivers, and depending on how much of your car you’re willing to cover with ads, Wrapify will pay you between $181 and $452 per month. There are also sites like FreeCarMedia.com that pay you for wrapping your vehicle or simply advertising on your rear window.

23. Create an App

If you’re a programmer who can create an app, this may be the best way for you to make passive income. Whether it’s a fun game or an app that provides value and convenience, use your creativity and skills to generate income. Apple and Google allow developers to submit their apps, giving you a percentage of the sale each time someone buys the app.

24. Flip Unique Items

One of the oldest ways to generate passive income is to buy unique items, hold them, and sell them at a later date for a profit. If you’re knowledgeable about a certain type of item or are willing to learn, you can make a decent amount of money by buying and holding items.

This is ideal for people who like shopping at thrift stores or going to garage sales. You may find antique toys, memorabilia, sports trading cards, comic books, or other items for a low price that are either worth a lot of money now or will be in the future.

To sell the items or see how much items are selling for, you can use websites like eBay, OfferUp, Craigslist, or Facebook Marketplace.

25. Rent Out Your Parking Space

Some people are willing to pay for a good parking spot. If you have a space you’re not using or don’t mind giving up, you can make money renting it out—especially if you live in an urban area. Websites like SpotHero allow you to list your space.

What’s the Best Source of Passive Income?

The best source of passive income is unique to each individual. There are many options on this list, and some allow you to capitalize on different skill sets. For example, if you have expertise in certain subjects, the best sources of passive income may be online courses and e-books. If you have knowledge about stocks or are willing to learn, investing may be the best option.

When deciding which passive income sources are right for you, it may be beneficial to weigh out the pros, cons, and risks of each one. Remember that many of these options require an initial investment of money and time to get started. Consider your own risk tolerance and financial situation before going all in on any of these methods.

Do You Need Money to Make Passive Income?

While you’ll need money to get started with many passive income ideas, this isn’t the case for every method. For example, if you own a vehicle or have an extra room in your home, you can start renting them out. If you have a computer and internet connection, you have even more options.

Many people who make passive income succeed because they are willing to learn and can invest time into researching these topics. There’s a wealth of information online where you can learn how to excel at specific passive income opportunities like writing an e-book, succeeding as a YouTuber, or using affiliate links.

The Benefits of Multiple Streams of Income

Depending on your specific situation, you may want more than one source of passive income. Whether you’re already in a healthy financial situation or are trying to build your personal wealth and credit score, more income streams means more financial freedom.

The primary benefit of passive income is that you can make money with minimal effort. This means once you get one source of passive income rolling, you can begin adding others so you have multiple income streams that don’t require too much time or attention.

How Passive Income Can Help Improve Your Credit Score

A poor credit score can lead to many challenges—like making it difficult to get approved for new lines of credit, loans, and rental applications—and cost you a lot of money in interest in the long run. Passive income can help you fix your credit by allowing you to pay off your debts. Lenders also look at your total income, so making additional income can help with approvals for new lines of credit, which can also help improve your score. It’s important to know the current state of your credit health. You can get a free credit report card on Credit.com which breaks down your credit score factors and assigns a letter grade for each area, or sign up for our ExtraCredit® subscription for additional credit tools.

You Might Also Like

March 11, 2021

Personal Finance

March 1, 2021

Personal Finance

February 18, 2021

Personal Finance