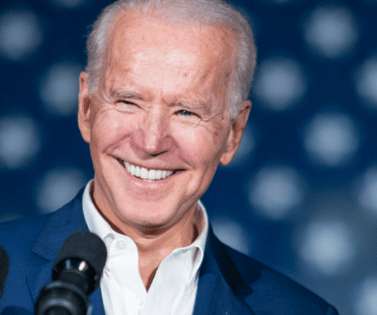

Gov’t Cancels $7.4B in Student Loans

Account Recovery

APRIL 15, 2024

billion in student loan debt relief for nearly 300,000 borrowers, many of whom were signed up for the administration’s new income-driven repayment program. The administration touted that this latest round of relief raised the total loan forgiveness to $153 billion, for more […]

Let's personalize your content