Daily Digest – March 25. Appeals Court Overturns $163k Attorney’s Fee Award; Judge Denies TCPA Claim Over Revoked Consent

Account Recovery

MARCH 25, 2022

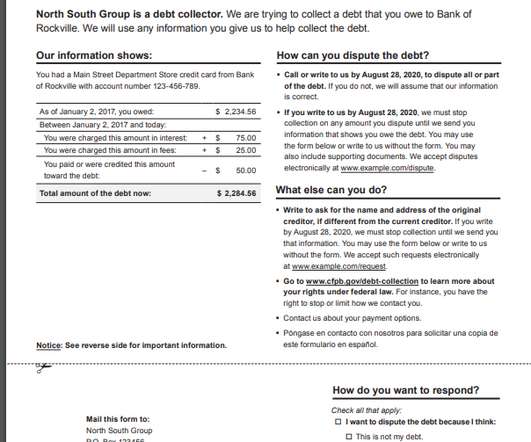

APPEALS COURT OVERTURNS $163K ATTORNEY’S FEE AWARD IN FAVOR OF DEFENDANTS IN FDCPA CASE The Court of Appeals for the Fifth Circuit has reversed a lower court’s decision ordering the attorneys representing a plaintiff in a Fair Debt Collection Practices Act and Texas Fair Debt Collection Practices Act case to pay $163,000 in attorney’s fees … The post Daily Digest – March 25.

Let's personalize your content