New Venmo Credit Card Offers Personalized Cash-Back Rewards

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

UPDATE Oct. 19, 2021: This article was originally published on Oct. 5, 2020, and has been updated to reflect the latest features of the card.

With the Venmo app, you can see the myriad ways in which your friends owe each other money, but now there’s another feature: the Venmo Credit Card.

Issued by Synchrony, the $0-annual-fee Venmo Credit Card offers cash-back bonus categories that change monthly to match your spending habits, along with a card user experience that’s managed through the Venmo app. As a Visa card, the Venmo Credit Card is widely accepted worldwide.

Features of the Venmo Credit Card

Personalized, automated bonus cash-back categories

Every month, your cash-back earnings shift to match the categories where you spend the most, based on the current month's activity. You’ll earn 3% back in your top category, 2% back in your second-place category and 1% on all other purchases. (See eligible bonus categories below.)

There is no sign-up bonus. The card's eligible 3% and 2% spending categories are as follows:

Grocery: This includes grocery stores and wholesale clubs.

Bills and utilities: Phone and internet service providers, streaming services, magazine and newspaper subscriptions, electricity, gas, water, trash disposal and other utilities.

Health and beauty: Drugstores, cosmetic stores, health clubs and other membership facilities like tennis, golf and swimming clubs.

Gas: Purchases at service stations that sell fuel.

Entertainment: Movie theaters, theatrical and concert promoters, video rental and game stores, books and newsstands, amusement parks, music stores, and toy and hobby stores.

Dining and nightlife: Dine-in, takeout and delivery from restaurants and fast-food establishments. Bars also are included.

Transportation: Rental cars, cabs and ridesharing services, limos, buses, trains, tolls, parking meters and garage parking.

Travel: Airlines, hotels and vacation rentals (including resorts, bed and breakfasts, cabins, hostels and timeshares).

Purchases that don’t fall into one of the above categories will not be eligible to earn 3% or 2% cash back, and that applies even if you use the card to send money to other Venmo users through your Venmo account.

Rewards customization is not unique among credit cards, but typically the ones that do feature it require you to "opt in" or actively select your preferred bonus categories from a list of several. The automation element is a growing trend in business and personal credit cards. (One example is the relatively new HMBradley credit card.)

Flexible reward redemption options

The cash back you earn will appear in your Venmo account balance. You can apply your rewards toward a credit card bill, send money to others through the Venmo app, pay for online purchases from merchants that accept Venmo at checkout or transfer the money to a linked bank account or debit card.

There is no minimum amount of cash back you must earn in order to redeem rewards, and cash back doesn’t expire.

Virtual and physical cards

Once your application is approved, you’ll have immediate access to a virtual card that you can use for online purchases until the physical card arrives in the mail. You can access the virtual card in the Venmo app, or add it to a digital wallet like PayPal wallet. Currently, you can’t add the Venmo Credit Card to Apple Pay.

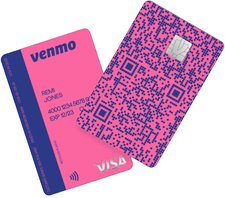

The physical Venmo Credit Card features tap-and-go contactless payment capabilities, as well as a unique QR code on the front of the card. When you receive your new card, you activate the card by scanning the QR code with your phone.

Much like the Venmo app, the card facilitates splitting purchases between multiple people, too. If you front the cost of a purchase with your Venmo Credit Card, the transaction appears on your app immediately with the option to split the cost. Then, your friends can scan the QR code on your card through their Venmo app to send their share. You can adjust your settings in the app to tell it where you want the money from your friends to go, whether that’s into your Venmo account balance or toward a credit card bill payment.

App-based card management

Within the Venmo app, you can track your spending activity in real time, see your cash-back earnings and pay your credit card bills. You can set up alerts that notify you of where and when purchases were made and when you earn cash back, which can help you stay on top of potentially fraudulent activity. If your physical card is lost or stolen, you can freeze it in the app and still use your virtual card to make purchases.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.