Legal Small Claims Recoveries in Victoria, Australia: How Does it Work?

Debt Recoveries

APRIL 28, 2020

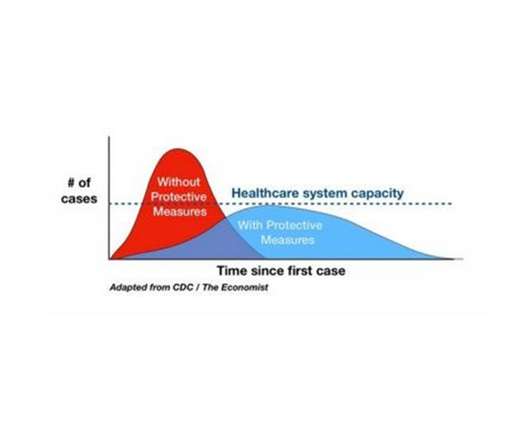

Recently we have been focussing on how to reduce your credit risks, promote cash flow deal with debtors during the COVID-19 crisis. However it remains a possibility that with some debtors, legal action may be the only the only course of action to secure your recovery. The courts are open and operating on reduced or amended schedules during this time, and most importantly, your rights to be repaid for monies owed have not changed so it is important you assess all options available to you.

Let's personalize your content