IRS Form 944: Instructions and Who Needs to File It

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

If your small business has employees, your business tax obligations include reporting the income and payroll taxes that you withhold from their paychecks.

Typically, this information is reported using IRS Form 941, also known as the Employer’s Quarterly Federal Tax Return. However, if your business is smaller and has less tax liability, you may be eligible to file a different IRS tax form: Form 944.

Here's everything you need to know about Form 944 and who's eligible to use it — along with step-by-step instructions to help you file your business return.

What is IRS Form 944?

Form 944 is an IRS tax form that reports the taxes — including federal income tax, social security tax and Medicare tax — that you’ve withheld from your employees’ paychecks. The IRS 944 Form is also used to calculate and report your employer Social Security and Medicare tax liability. This form was created particularly for smaller businesses that have fewer employees and thus less tax liability.

Unlike IRS Form 941, which reports much of the same information, but must be filed quarterly, Form 944 is an annual tax return. Businesses whose employment tax liability will be $1,000 or less — or in other words, you expect to pay $4,000 or less in total employee wages for the year — are eligible to file IRS Form 944. Therefore, if you’re eligible to complete Form 944 instead of Form 941, you only have to file an employment federal tax return (and pay any taxes owed) once a year.

How much do you need?

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Who needs to file Form 944

Most businesses need to complete Form 941 on a quarterly basis to fulfill the IRS requirements for reporting and calculating employment taxes. This being said, certain businesses are eligible to complete IRS Form 944 annually instead. Again, the rule of thumb for this eligibility is if you expect your employment tax liability to be $1,000 or less for the year.

However, to be able to file Form 944 instead of Form 941, you must be notified in writing of your eligibility by the IRS. The IRS may notify you that your business is either eligible or required to complete Form 944. If you’re required to complete Form 944, you must file this form and cannot file Form 941 in its place unless you’ve requested and received permission from the IRS to do so. Conversely, if you’re only eligible, not required, to complete Form 944, you may still continue to submit Form 941 on a quarterly basis if you so choose.

Additionally, if you have not received an IRS notification that you’re eligible to complete Form 944, but you believe your employment tax liability meets the aforementioned requirements, you can contact the IRS by phone or mail to request this change. It should be noted though, this request must be made within the first few months of the year. If the IRS does change your file requirements, they’ll again send you a written notice.

Another important consideration, however, is that even if your business meets the lower tax liability requirement, there are two scenarios where you would still be ineligible to complete IRS Form 944 instead of 941: first, if you only employ household employees and second, if you only employ agricultural employees.

Furthermore, if you’re a new employer, you may request to be eligible to complete IRS Form 944. When you’re completing Form SS-4, the application for an employer identification number (EIN), you can specify that you think you’ll meet the Form 944 filing requirements. When you’re issued your EIN, the IRS will inform you of your employment tax filing requirements — either IRS 944 or 941.

Where to find Form 944 and how to file

If you’ve received notification to complete IRS Form 944, you’ll want to know where to find this tax form, how to file it,and when you need to file it, especially as the latter differs greatly from Form 941. Just as you can with other business IRS tax forms, you can find Form 944 on the IRS website. With the IRS 944, you have a few ways to complete it and file it. First, of course, you can file physically. You can either print Form 944, fill it out by hand and mail it, or you can fill it out on your computer, print it and mail it. The IRS Form 944 instructions specify to what location you can file this return, as it differs depending on your state and whether or not you’re filing with a payment.

You can also file Form 944 electronically and the IRS actually encourages you to do so. To file this form electronically, you can utilize the IRS E-file system, which provides you with two options. First, you can submit the forms yourself utilizing an IRS-approved software provider. Second, you can use the services of a tax professional who is IRS authorized for e-filing to file on your behalf. Additionally, if you already use an accounting or payroll service, your provider may have the functionality for you to complete the IRS 944 and file it through their system.

The deadline for filing Form 944 is different from Form 941, as IRS 944 is an annual form, not a quarterly one. This being said, the deadline to file Form 944 is Jan. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due Jan. 31, 2022. If, however, you’ve made deposits on time and in full payment of the taxes due for the year, you have a few weeks of extra time to file. The exact date of this extension may vary year to year, but generally it falls around Feb. 11.

FEATURED

Form 944 instructions: A step-by-step guide

Now that you've got a basic understanding of IRS Form 944, let’s dive deeper and learn exactly how to complete it. These Form 944 instructions will take you step-by-step through the process of how to fill in the five parts on the two pages of this IRS tax form.

Step 1: Gather payroll data and fill in your basic business information.

The first thing we’d recommend doing when starting the Form 944 process is to prepare the information you’ll need ahead of time so that it’s easily accessible. Since this form relates to payroll taxes, both FICA taxes (Social Security and Medicare taxes) and the federal income taxes that you’ve withheld from your employees’ wages, you’re going to need access to this information, plus, the total compensation you’ve given to your employees throughout the year. Once again, if you’re utilizing an accounting or payroll software, these systems are great ways to access these numbers quickly and easily. Your particular system might also be able to generate a report specifically detailing all of the information you need for Form 944.

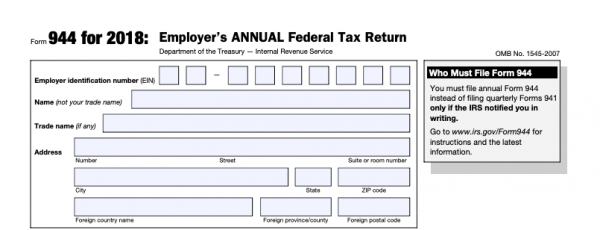

With the proper data in hand, it’s time to actually get started. On the first page of Form 944 (as you’ll see below), you’ll notice the section asking for basic, identifying information about your business. Here, you’ll fill in your EIN, name, trade name (if you have one) and address.

Source: IRS

Step 2: Fill in Form 944 Part 1.

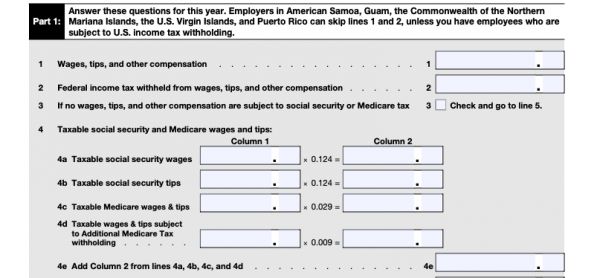

In Part 1 of Form 944, the first two boxes that you’ll complete will report the total wages you paid to your employees for the year and the total federal income tax for the year that you withheld from these wages. Next, you’ll be asked about whether the wages you detailed in box 1 are subject to Social Security or Medicare taxes. If the answer is no, you’ll check box 3 and move on to box 5. If the answer is yes, however, then you’ll need to complete line item 4 and its four sub-parts.

Calculating taxable Social Security and Medicare wages

Through the boxes of line item 4, you’ll calculate your taxable social security and Medicare wages. To do so, you’ll fill column 1 with the appropriate social security wages, social security tips, Medicare wages and tips, and wages and tips subject to additional Medicare withholding. Then, you’ll multiply each of the boxes in column 1 by the tax rate specified and fill the total amount in the respective box in column 2. The decimal amounts that you see on Form 944 below reflect the percentage of wages and tips that get deducted for Social Security and Medicare tax.

Once you’ve made these calculations and filled in the appropriate amounts in columns 1 and 2, you’ll add up the numbers in column 2 and fill this total in box 4e.

Photo credit: IRS

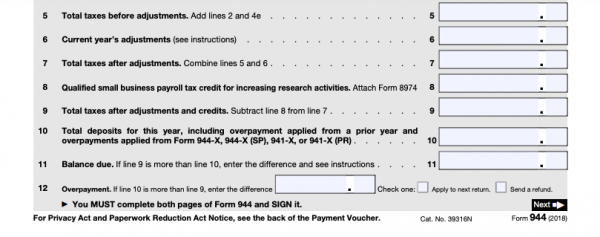

Next, you’ll continue to complete the boxes in Part 1. In box 5, you’ll add lines 2 and 4e to determine your total taxes before adjustments. In box 6, you’ll fill in any adjustments you need to make for sick pay or life insurance as specified on the IRS Form 944 instructions document. To determine your total taxes after adjustments, you’ll combine the totals from box 5 and box 6 and fill in the proper amount in box 7.

If your business can claim any tax credit for performing or participating in research, you’ll add this amount in box 8. In box 9, you’ll subtract box 8 (if applicable) from box 7 to report your total taxes after adjustments and credits. Once you’ve completed up to box 9, you’ll be able to calculate your final employment tax liability. To do so, you’ll report any deposits you’ve already made for the year in box 10 and then compare it to the total in box 9. If box 9 is more than line 10, you’ll enter the difference in box 11 — this will dictate your tax liability, which you then must pay to the IRS.

On the other hand, if line 10 is more than line 9, you’ll indicate overpayment in line item 12 and indicate if you’d rather the IRS refund you that amount or apply it to your next return.

Photo credit: IRS

Step 3: Fill in Form 944 Part 2.

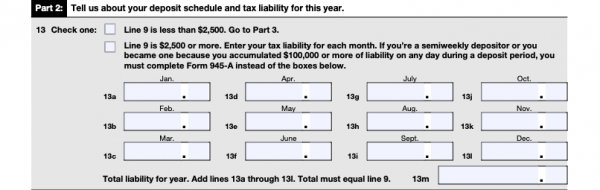

After completing line 12, you’ll move on to the second page of IRS Form 944 and begin to complete Part 2. This part of the form will ask you to report your business’s deposit schedule and tax liability for the year. First, you’ll be asked to check either: line 9 is less than $2,500 or line 9 is more than $2,500. As a reminder, line 9 refers to your total taxes after adjustments and credits. If this total is less than $2,500, you’ll move on to Part 3. On the other hand, if line 9 is greater than $2,500, you’ll be asked to enter your tax liability for each month of the year. You’ll then add the numbers in boxes 13a through 13l and record your total liability for the year in 13m. This amount must match the amount you recorded in line 9.

Photo credit: IRS

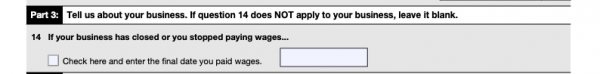

Step 4: Fill in Form 944 Part 3.

In Part 3, you’ll be asked if your business has closed or if you stopped paying wages. If this applies to your business, you’ll check the box and enter the final date you paid employee wages. If question 14 does not apply to your business, you’ll leave it blank and move on to Part 4.

Photo credit: IRS

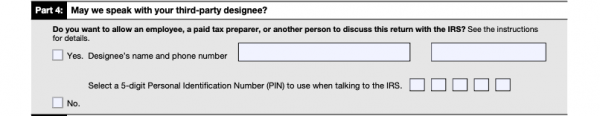

Step 5: Fill in Form 944 Part 4.

Part 4 of IRS Form 944 will ask if you grant the IRS access to speak with a third-party designee. A third-party designee refers to an employee, tax preparer or other person, like your certified public accountant, who you would allow to speak to the IRS regarding this return on behalf of your business. By providing a third-party designee, this person should be able to answer any questions the IRS has when processing your return as well as provide them with any missing information, call for information about your return and respond to certain IRS notices with regard to this return. If you don’t want to provide a third-party designee, simply check the “no” box in Part 4.

Photo credit: IRS

Step 6: Fill in Form 944 Part 5.

The last part of Form 944, Part 5, will ask you to sign your name, affirming that you’ve examined the return and believe, to the best of your ability, that it’s correct and complete. You will also date IRS Form 944 and print your name, title and phone number in the appropriate boxes. If you used a paid preparer, like an enrolled agent, for example, this individual would fill in their information in the section designated “Paid Preparer Use Only.” Your paid preparer will fill in their name, signature, date and preparer tax identification number (PTIN) — as well as your business’s name, EIN, address and phone number.

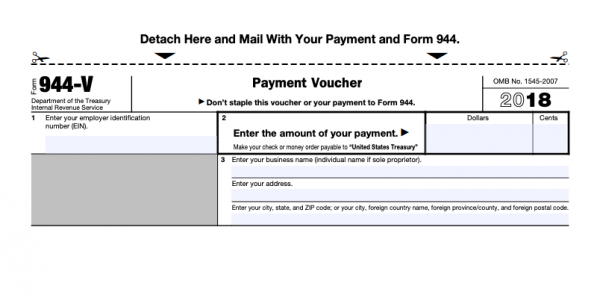

Step 7: File Form 944 and make a payment to the IRS, if necessary.

Once you or your tax preparer reviews Form 944 and signs off accordingly in Part 5, the form is complete. Now, you’ll need to file the form with the IRS. You can file either physically or electronically, but either way you must adhere to the Form 944 deadline.

Additionally, there are a few specific instances in which you should make a payment when you file Form 944. Generally, however, you should be making employment tax deposits throughout the year. Your deposit schedule will depend on the size of your business’s tax liability and must be made by electronic funds transfer. The IRS recommends that you utilize the Electronic Federal Tax Payment System (EFTPS), but you can also arrange for a tax professional, payroll service or other similar third-party to make these electronic deposits on your behalf.

This being said, you should make a payment with IRS Form 944 when you file if:

Your net taxes (in box 9) are less than $2,500.

Your net taxes (in box 9) are $2,500 or more, you’ve already deposited the taxes you owed for the first three quarters of the year and your net taxes for the fourth quarter are less than $2,500.

You’re a monthly schedule depositor who owes a small balance — no more than $100 or 2% of the total tax due, whichever is greater.

If you fall into one of these categories, there are a few different ways you can pay your balance, depending on how you’re filing Form 944. If you’re filing Form 944 by mail, you can complete Form 944-V, the payment voucher that is found at the end of the IRS 944 PDF on their website. When you file Form 944, then, you’ll complete this payment voucher, include a check or money order with the proper amount and mail the three pieces to the proper address.

Photo credit: IRS

On the other hand, if you file electronically, you’ll be able to pay your balance online by electronic funds withdrawal through the system you’re using, either through your tax-preparation software or a tax professional. With this option, you’ll only face a fee if your particular bank charges fees for this kind of transaction.

Finally, for both mail and electronic filing, you also have the option to pay your balance via credit or debit card. If you choose to do this, you’ll work with one of the IRS third-party payment processors, who will charge you a processing fee.

A version of this article was first published on Fundera, a subsidiary of NerdWallet