Can You Get a VA Loan With Bad Credit?

Credit Corp

JANUARY 24, 2024

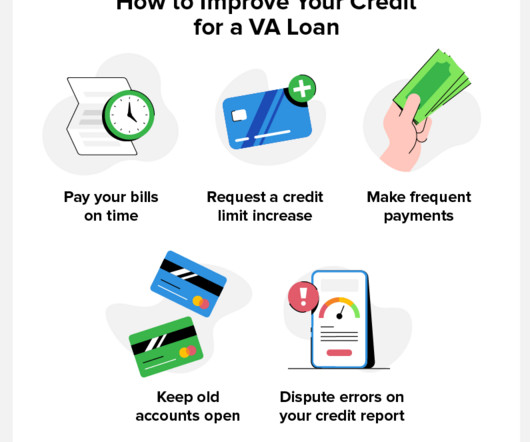

While there is no minimum requirement, most lenders prefer a credit score of 620 or above. While VA loans are typically easier to get approval for than conventional loans, private lenders still have certain requirements you must meet. One of these requirements is typically a good credit score.

Let's personalize your content