Can You Get a VA Loan With Bad Credit?

Credit Corp

JANUARY 24, 2024

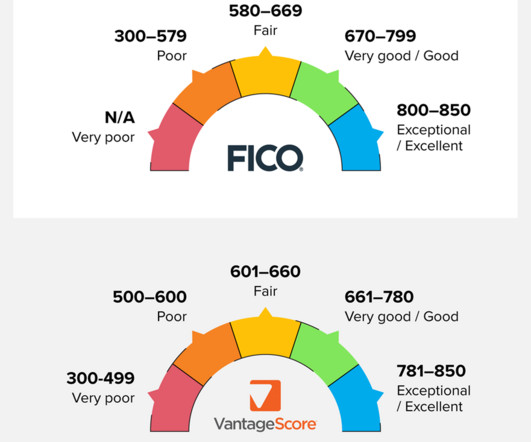

Table of Contents: What Is the Minimum Credit Score for a VA Loan? Compensating Factors Your Lender May Take Into Account Other VA Loan Requirements How to Get a VA Loan After Bankruptcy or Foreclosure Who Qualifies for a VA Loan? Here’s an overview of how to get a loan after foreclosure or bankruptcy.

Let's personalize your content