The COVID-19 crisis has rapidly changed the way individuals and businesses operate around the world, and with no clear end to the pandemic in sight, it’s unclear when, or how quickly, the economy will start to recover. To better understand the effect this uncertainty has had on debt collection, we analyzed data from over 12 million consumers of major banks, issuers, eCommerce companies, and direct lenders.

In our upcoming report, Consumer Debt in the Age of COVID-19, we use this data to review consumer repayment trends, the role of stimulus checks in that process, and what debt collection companies will need to do to adapt.

Here’s what you can expect from the report:

- Pre-coronavirus payment insights. In order to provide a benchmark for new or rapidly changing consumer behavior, we reviewed common pre-pandemic payment trends, like payment surges during tax season.

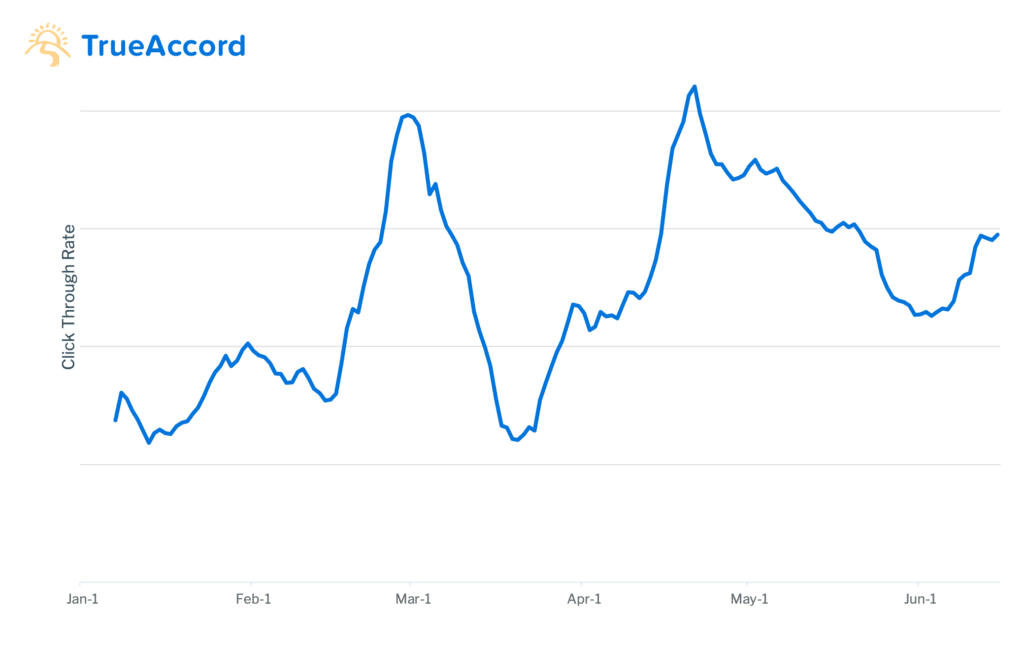

- COVID, CARES, and consumer concerns. We tracked consumer behaviors around engagement and payments throughout the crisis—from the onset to the declaration of a national emergency, passing of the CARES Act, distribution of stimulus checks, and beyond. Consumers were clearly concerned early in the crisis—engagement with debt was down 40% year over year in mid-March—but when stimulus checks provided an infusion of cash, consumers overwhelmingly chose to use it to pay their debts.

Click through rates plummeted in March as the crisis worsened, only to reach a record high post-stimulus.

- What’s next for debt collection? As the crisis continues and consumer payments are slowing, debt collectors must adapt to survive. Based on the payment and engagement trends outlined in the report, we share four key steps debt collection companies can take to best serve consumers in the “new normal.”

If you’re interested in reading the full report, fill out the form below to get notified when it goes live.